What Income Do I Put On Fafsa

For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC.

How To Get Financial Aid Making Multiple Six Figures A Year

Well it is not necessarily the one that has legal custody.

What income do i put on fafsa. In addition to adjusted gross income from the 2018 tax return the FAFSA asks for a breakdown of each parents earned income taxable income untaxed income and additional financial information. The chart below from the EFC Formula Guide shows the components of parent income. The most you would be able to get depending on what the financial aid administrator at your college decides would be a loan called an unsubsidized loan.

This information may be on the W-2 forms or on the tax return selected in question 80. The questions change a little from one years application to the next years. Your answers to questions on the FAFSA form determine whether you are considered a dependent or independent student.

The FAFSA asks about income as well as assets. One workaround is to offset the capital gains with losses. Parents of current college students should plan their FAFSA filing around tuition due dates since most schools have a later FAFSA deadline for continuing students.

Include your personal income and assets on the FAFSA. The impact of this change is discussed below including the legislative basis criteria for exclusion other exclusions special rules for business or farm debt and the relevance to rental. Capital gains during the base year will count as income on the FAFSA and CSS Profile.

Child support paid because of divorce or separation or as a result of a legal requirement. Gain in the 529 account is not reported as income on either the tax return or the FAFSA. You only include the income of your custodial parent which includes any alimony andor child support paid by the noncustodial parent.

Return To FAFSA Guide. The FAFSA will want information on available cash balances in savings and checking accounts and any investment portfolios. Use the information from your Form W-2s to report income earned by the student and parents.

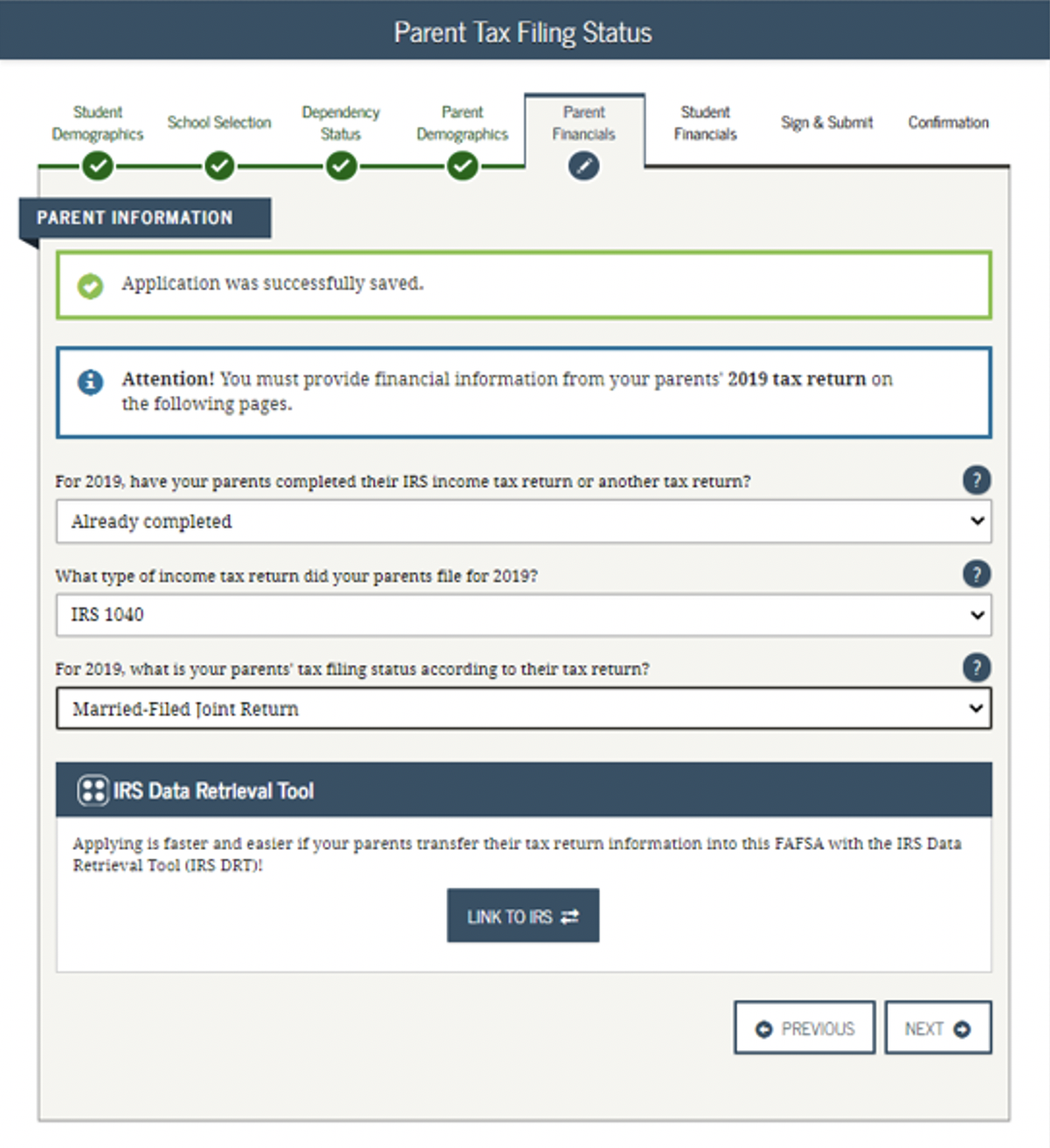

Who Is the Custodial Parent. The FAFSA will tell you what to do if you are in this situation. How to Answer FAFSA Question 86-87.

Students 2019 Additional Financial Information Enter the combined amounts for you and your spouse Education credits American Opportunity Tax Credit and Lifetime Learning Tax Credit from IRS Form 1040 Schedule 3 - line 50. Answer the questions whether or not a tax return was filed. This is the secret sauce of 529s vs taxable investment accounts.

For instance the 202122 FAFSA form asks whether you were born before Jan. On the FAFSA the application will be considered rejected and you might not be able to receive any federal student aid. The EFC is calculated based on the parents adjusted gross income AGI which includes all sources of taxable income such as wages taxable interest and dividends capital gains business income.

Question 86 and 87 ask about earnings wages salaries tips etc in 2019. 1 1998 while the 202223 FAFSA form will ask whether you were born before Jan. Return To FAFSA Guide.

Small Business Exclusion Since July 1 2006 small businesses that are owned and controlled by the family are excluded as assets on the Free Application for Federal Student Aid FAFSA. Report any financial support received from legal guardians or foster parents on Worksheet B. Another option is to realize the capital gains prior to the base year for the FAFSA eg prior to January 1 of the sophomore year in high school.

IRS Form 1040line 1 Schedule. But who is your custodial parent.

How Much Is Too Much Income To Qualify For Financial Aid

Reporting Parent Information Federal Student Aid

11 Common Fafsa Mistakes U S Department Of Education

11 Common Fafsa Mistakes U S Department Of Education

True Or False You Can Fill Out Your Fafsa Before Filing Taxes U S Department Of Education

The Fafsa Application Collegechoice

How To Complete The 2021 2022 Fafsa Application

Fafsa Basics Parent Assets The College Financial Lady

11 Common Fafsa Mistakes U S Department Of Education

How To Complete The 2021 2022 Fafsa Application

Posting Komentar untuk "What Income Do I Put On Fafsa"