What Are The Income Guidelines To Qualify For Fafsa

National or permanent resident and have a valid Social Security number. But there are no simple FAFSA income limits or income cutoffs on financial aid eligibility in part due to the complexity of financial aid formulas.

What Is The Income Limit For Fafsa 2021

Financial aid comes in many forms and is unique to each situation.

What are the income guidelines to qualify for fafsa. To be eligible for the FAFSA youll need. Customers initially applying must meet the 200 FPG Initial Eligibility income requirement to receive financial assistance for child care. For 2019-2020 the income protection allowance for a married couple with two children in college is 25400.

With the cost of the most expensive colleges today now in excess of 65000 per year even students from families with incomes over 200000 can qualify for need-based aid. In fact according to research from the National Center for Education Statistics 32 who didnt submit the FAFSA didnt do so because they thought that they wouldnt qualify. A high school diploma or GED.

For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. Families with adjusted gross incomes AGI of 25000 or less have an automatic EFC of 0. As mentioned above there is no income limit for FAFSA this year.

The EFC for the average American household with an AGI of 55000 will often range from 3000 to 4000. Income eligibility limits are set in TWIST. Be enrolled or accepted as a student in an eligible degree or certificate program.

If youre a dependent student and your familys annual income if less than 26000 your EFC will be considered zero. What is the Income Cap for Federal Student Aid. The Free Application for Federal Student Aid FAFSA does ask for a lot of financial information from parents including details about your incomeThis may have you wondering if there are ways to reduce your income to help increase your childs financial aid eligibility.

Other common sources of uncounted income include. This post explains the other part of the equationhow to shelter your assets to maximize your aid. To qualify for financial aid youll need to verify your citizenship enrollment status and financial need.

In addition to basic eligibility there are also academic institutional service and administrative requirements. This may come as a surprise to you but there are no income requirements or cap to the amount of money you can earn to qualify for federal student aid. Anna Helhoski Sep 29 2020.

These families have significant financial aid needs. Citizen or eligible noncitizen like. To be a US.

FAFSA eligibility requirements. At recertification a customers income cannot exceed the 85 SMI sustaining income limits to continue receiving financial assistance for child care. Many factors go into the financial aid equation such as as taxed and untaxed income assets number of children in college and parent age.

Have a high school diploma or GED certificate. This is an important question because many families think that their income is too high to qualify for financial aid. In general there must be some type of demonstrated financial need to qualify for certain types of federal financial aid but there is no income cap.

But there is a cap on the earning technically the lowest threshold of income which means your Expected Family Contribution EFC will stand at 0. If your family has an adjusted gross income of 26000 or less your EFC is calculated at zero and you can qualify for up to the maximum amount in Pell Grant funding if your school costs more than 6195 a year to attend. Currently the FAFSA protects dependent student income up to 6660.

What Are the FAFSA Requirements. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC. Citizen or an eligible noncitizen including a US.

There is no specific income limit. Unless the parents earn more than 350000 a year have only one child and that child will enroll at an in-state public college they should still file the FAFSA as there is a good chance they may qualify for federal state or institutional grants. For parents the allowance depends on the number of people in the household and the number of students in college.

The FAFSA application uses a complex need analysis formula to evaluate income number of people in the household and in college age of the eldest parent investments cash savings checking and even the state of legal residence. If your family makes less than 30000 a year you likely will qualify for a good amount of Pell Grant funding. To qualify you must meet the basic eligibility requirements for federal funding.

Youre also required to complete the FASFA to determine if you qualify for the grant and how much funding youre eligible to receive. The Free Application for Federal Student Aid or FAFSA looks at both your family income and assets in determining your eligibility for college aid. At minimum you must.

In a previous post I outlined steps you can take now to reduce the income you must report on the FAFSA.

Financial Aid Application Is Simpler And Available Earlier But No Panacea

Financial Aid Eligibility Federal Student Aid

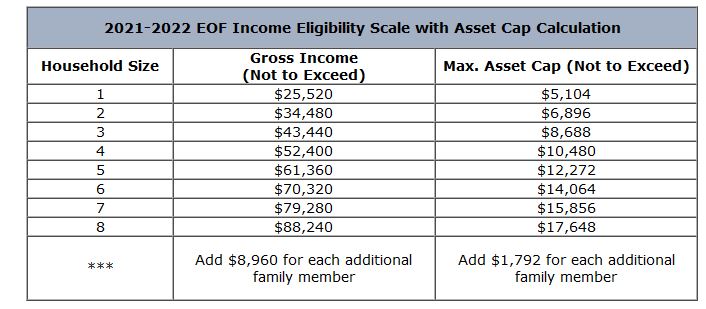

Eligibility Requirements Educational Opportunity Fund Stockton University

Do You Earn Too Much To Qualify For College Financial Aid

Do I Make Too Much To Qualify For Financial Aid Greenbush Financial Group

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

Do You Earn Too Much To Qualify For College Financial Aid

Fafsa Eligibility Guide To Qualify And Apply For Federal Student Aid

How Much Is Too Much Income To Qualify For Financial Aid

What Is The Maximum Income To Qualify For Fafsa 2019

What Is The Maximum Income To Qualify For Fafsa 2019

Posting Komentar untuk "What Are The Income Guidelines To Qualify For Fafsa"