What Is The Income Threshold For College Financial Aid

You can waive the fee but only if the student is eligible for an SAT waiver parental income is less than 45000 or the student is an orphanward of the court and under 24 years old. So even if the household income is 175k that would determine if you get any money from the college but youd not get any from the federal government.

Do My Savings Affect Financial Aid Eligibility Money

If you get a 10000 bonus and take home 6000 of.

What is the income threshold for college financial aid. What is the income limit to qualify for financial aid. That means that you can expect to receive a different financial aid package at every college you are accepted to. For a single surviving spouse the basic MAPR in 2020 is 9224 and the deductible is 461.

You provide this information. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC. Many families assume they wont qualify for financial aid and dont even bother to apply.

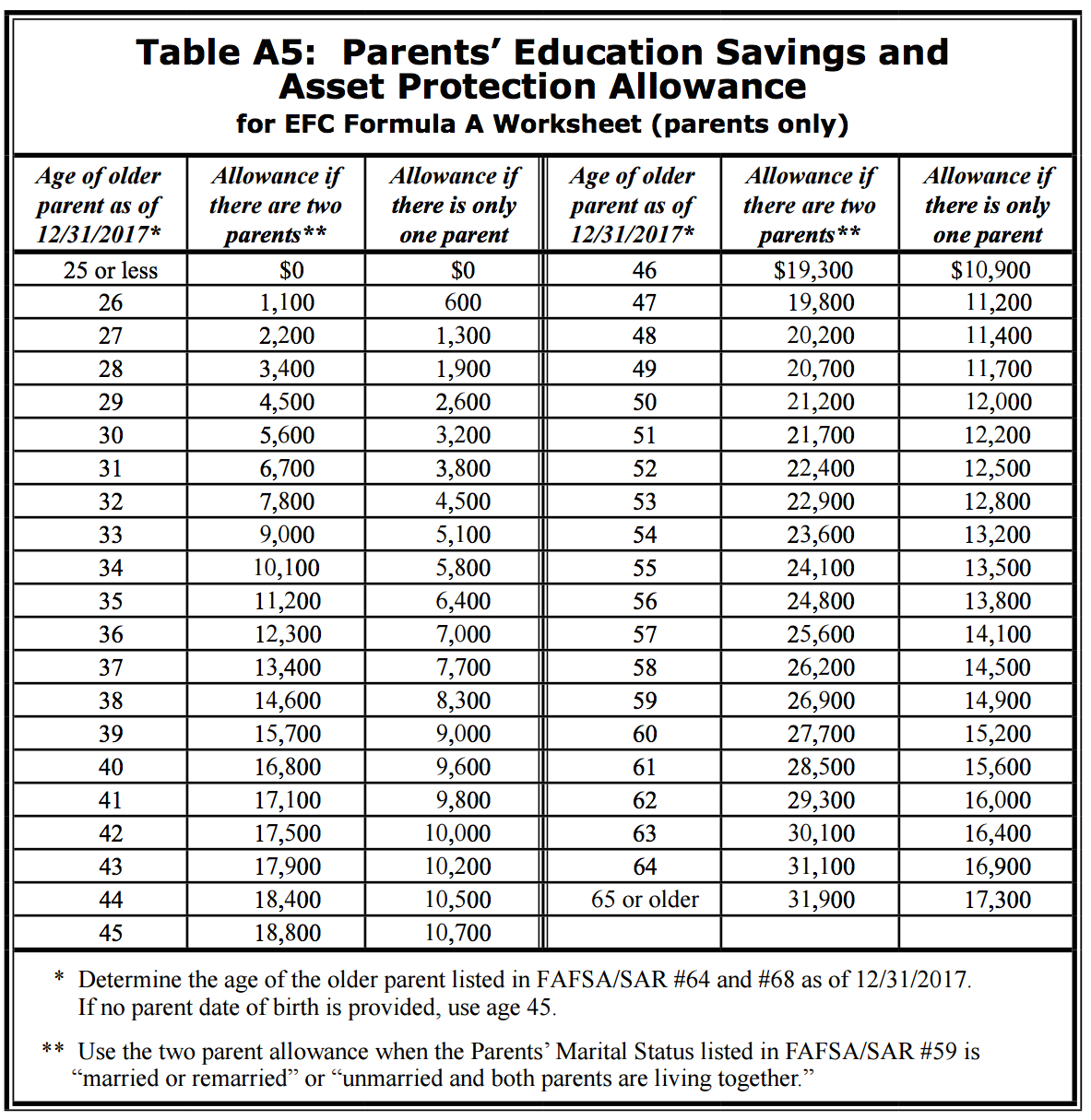

A college would expect a students family to pay at least 25000 towards one year of schooling. The FAFSA application uses a complex need analysis formula to evaluate income number of people in the household and in college age of the eldest parent investments cash savings checking and even the state of legal residence. Bear in mind that the CSS Profile is not free.

For example Rutgers University works along with the New Jersey Educational Opportunity Fund to determine eligibility and then awards between 200 and 2500 to eligible students. CSS is a companion while FAFSA does determine if you receive pell grants it also the document used by the college to calculate institution aid. The amount of your award is based on your demonstrated financial need which is determined from the information on your FAFSA.

There is in fact no income cap. Thats right about 20 of private school students nationwide receive some form of financial aid to defray the cost of tuition which averages about 20000 at day schools and closer to 40000 or more in many urban areas on the East and West Coasts and over 50000 at many boarding schools. If your family makes 60000 a year or more you will probably not qualify for Pell Grant funding.

Note that student employment can have a big impact on aid. There is no specific income limit. While income is an important factor in determining aid eligibility there are a myriad of other factors including the cost of individual colleges.

For the 2015-2016 year the maximum Pell Grant award is 5775. Unless the parents earn more than 350000 a year have only one child and that child will enroll at an in-state public college they should still file the FAFSA as there is a good chance they may qualify for federal state or institutional grants. If youre a dependent student and your familys annual income if less than 26000 your EFC will be considered zero.

With college expenses of 21000 and a student contribution of 2000 each student now has a financial need of 10000 21000 less an EFC of 11000 and both will be eligible for some financial aid. How financial aid is calculated. One nice thing about the aid calculators is that they allow a deduction from income for income taxes including federal tax.

The Hope Scholarship tax credit is available to families with income up to 90000 single filers and 180000 married filing joint. You can be extremely wealthy and still qualify for these loans. It costs 25 to submit to the first school and 16 for each school after that.

Currently the FAFSA protects dependent student income up to 6660. But there is a cap on the earning technically the lowest threshold of income which means your Expected Family Contribution EFC will stand at 0. Also the pell grant Im not certain can award aid if is below 75k but after 60k its very.

In fact there is no income cutoff for eligibility. Parents often wonder if there is a maximum income above which families are no longer eligible for financial aid. If your family makes between 30000 and 60000 per year you can qualify for some funding but likely not the full amount.

Some colleges use state income scale guidelines to determine students eligibility for financial aid in addition to FAFSA. The Pell Grant is intended to help low-income students finance their post-secondary education. Claimants qualifying on income alone without a rating for aid and attendance or housebound typically need to make such little money they are likely below the poverty level.

For 2019-2020 the income protection allowance for a married couple with two children in college is 25400. As mentioned above there is no income limit for FAFSA this year. For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero.

Other common sources of uncounted income include. The exact 201920 award. But there are no simple FAFSA income limits or income cutoffs on financial aid eligibility in part due to the complexity of financial aid formulas.

Every college will calculate financial aid according to their own unique formula. The major reason that there is no income limit to apply for financial aid is because financial aid is very complex. For parents the allowance depends on the number of people in the household and the number of students in college.

Do You Earn Too Much To Qualify For College Financial Aid

Affording A Duke Education Duke Financial Aid

How Much Is Too Much Income To Qualify For Financial Aid

Do You Earn Too Much To Qualify For College Financial Aid

Fafsa For 2021 Income Limits Aid Types And More Student Loan Hero

Answered A College Has A Financial Aid Formula Bartleby

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

5 Ways California S Financial Aid Program Can Better Serve Students California Budget Policy Center

Trustees Set 2020 21 Tuition Again Expand Financial Aid For Middle Income Families Stanford News

Financial Aid Eligibility Federal Student Aid

Financial Aid Methodist University

Posting Komentar untuk "What Is The Income Threshold For College Financial Aid"