What Income Is Used For Fafsa

So if the parents have one child in college and have an earned income of 140000 their EFC will be about 30000 per year for that child. Return To FAFSA Guide.

How To Complete The 2021 2022 Fafsa Application

You only include the income of your custodial parent which includes any alimony andor child support paid by the noncustodial parent.

What income is used for fafsa. For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. The EFC is calculated based on your Adjusted Gross Income AGI and other income sources and schools use it. What Does the Income Determine on the FAFSA.

Currently the FAFSA protects dependent student income up to 6660. Are you trying to figure out what income information to provide for your parents where they are divorced and you are living with one of them. Answer the questions whether or not a tax return was filed.

What Is Adjusted Gross Income. How much income is too much for fafsa. Once the income is above 100K roughly 15th to 14th of income will be counted towards your EFC.

With two children in college the parents EFC will. Many factors besides incomesuch as your family size and your year in schoolare considered to determine your aid package. Its hefty and uncomfortable for most families.

In addition to adjusted gross income from the 2018 tax return the FAFSA asks for a breakdown of each parents earned income. Report the current amounts as of the date you sign the FAFSA form rather than reporting the 2018 tax year amounts. Will fafsa cover my entire tuition.

That can get confusing but fortunately here is the answer. Question 86 and 87 ask about earnings wages salaries tips etc in 2019. For any amount above your income protection allowance roughly every 10000 in extra income lowers your financial aid qualification by another 3000.

The EFC is calculated based on the parents adjusted gross income AGI which includes all sources of taxable income such as wages taxable. That also means that any income planning you may be contemplating for middle school and early high school-aged kids. The FAFSA weighs parents income much more heavily than parent assets assessing income according to a scale of 22 to 47 percent of available income.

YES these are income and must be reported. The chart below from the EFC Formula Guide shows the components of parent income. This information may be on the W-2 forms or on the tax return selected in question 80.

Other common sources of uncounted income include. This income-related figure comes from your federal tax return and reflects how much you earn minus a few standard deductions. It is important that the FAFSA forms are filled out accurately including recording all appropriate income.

This section includes savings and checking account balances as well as the value of investments such as stocks bonds and real estate excluding your primary residence. On your FAFSA you will be asked for work-study earnings so that these can be subtracted from your income. As you fill out the FAFSA youll notice that the form requires you to supply your Adjusted Gross Income.

The FAFSA considers student income in addition to parent income for dependent students or spousal income for married and therefore independent students. Parent income tends to be overlooked in FAFSA planning which is unfortunate because for most families its the biggest piece and one that has some real planning opportunities. If youre filing as a dependent student youll also need to supply your parents AGI.

Roth IRA or other nontaxable distributions from retirement accounts. Work Study earnings. IRS Form 1040line 1 Schedule.

Income information is used to calculate a reasonable percentage of your familys income and assets that can be used to contribute to your students college education which is known as the Expected Family Contribution EFC. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC. This is one of many reasons not to use a Roth IRA as your college savings vehicle.

Im not sure how which percentage is arrived at. For 2019-2020 the income protection allowance for a married couple with two children in college is 25400. NO these are not income.

For parents the allowance depends on the number of people in the household and the number of students in college. In other words parents of the Class of 2017 can file their FAFSA right now. For parents and students the FAFSA utilizes the Adjusted Gross Income AGI figure from the relevant tax return as a starting point for income-related calculations.

When you fill out the FAFSA form youre automatically applying for funds from your state and possibly from your school in addition to federal student aid. How to Answer FAFSA Question 86-87. The Free Application for Federal Student Aid FAFSA looks at a students available assets and determines the amount of money that student is qualified to receive to help pay for college.

Faqs And Tips For Completing The 2021 22 Fafsa Uf Office Of Student Financial Aid And Scholarships

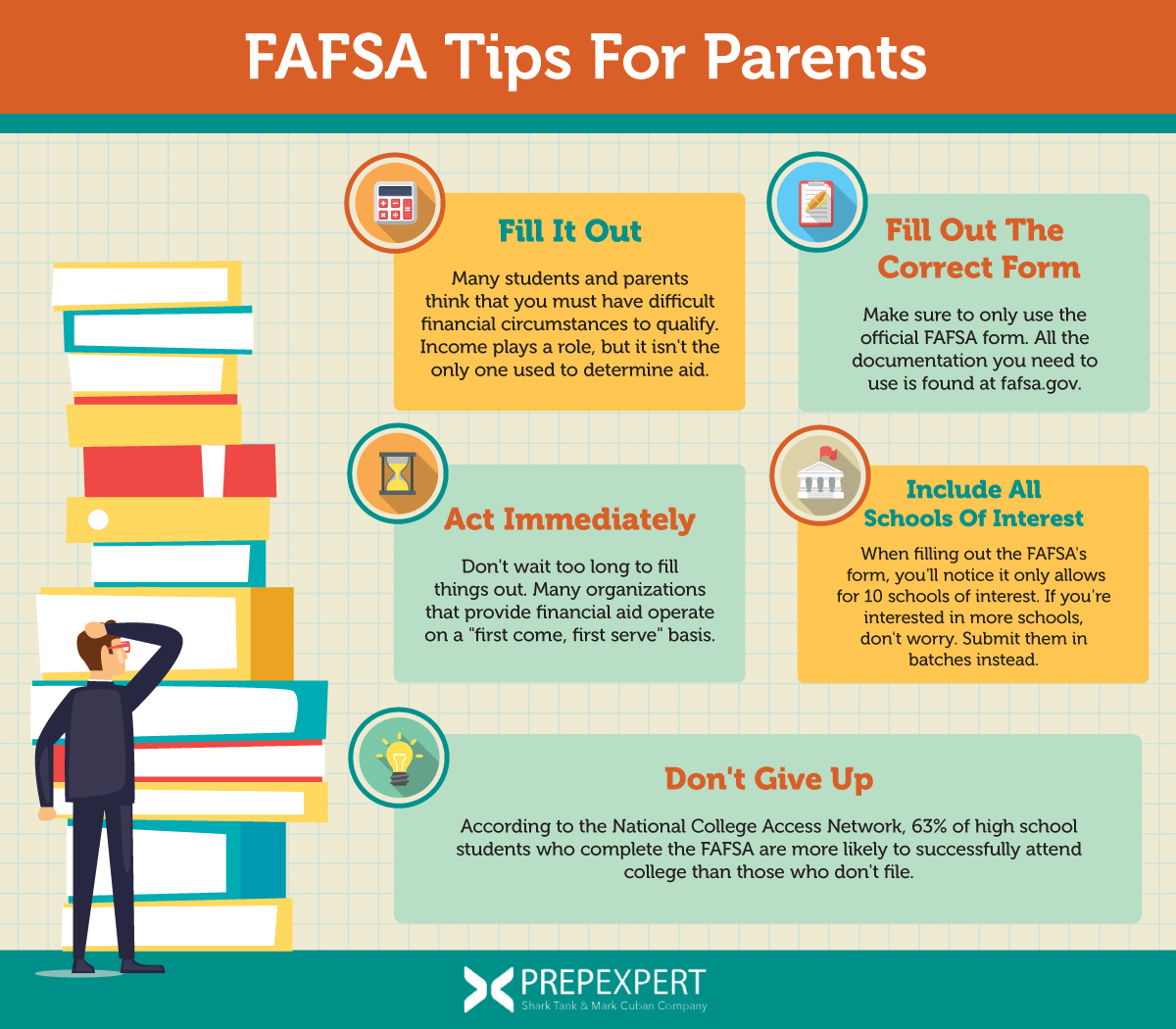

Fafsa Tips For Parents Prep Expert

How Much Is Too Much Income To Qualify For Financial Aid

Money Under 30 S Guide To Filling Out The Fafsa Money Under 30

Vernon College Fafsa It S Really Not That Difficult

Federal Income Tax Form Simplification Complicates Fafsa Form

Understanding Fafsa How To Qualify For More College Financial Aid Greenbush Financial Group

Reporting Parent Information Federal Student Aid

How Much Is Too Much Income To Qualify For Financial Aid

How To Complete The 2021 2022 Fafsa Application

The Fafsa Application Collegechoice

Posting Komentar untuk "What Income Is Used For Fafsa"