What Is The Qualifying Income For Fafsa

The FAFSA Simplification Act was included in the Consolidated Appropriations Act of 2021 taking up 167 pages of the 5593-page bill. Your income must be equal to or less than the amount indicated based upon your family household size as indicated in the table below.

Taxes Fafsa Efc Financial Literacy Ecpi

Family size on the FAFSA includes the student the students parents and any dependents of the students parents in the tax year upon which the FAFSA bases income and tax information eg.

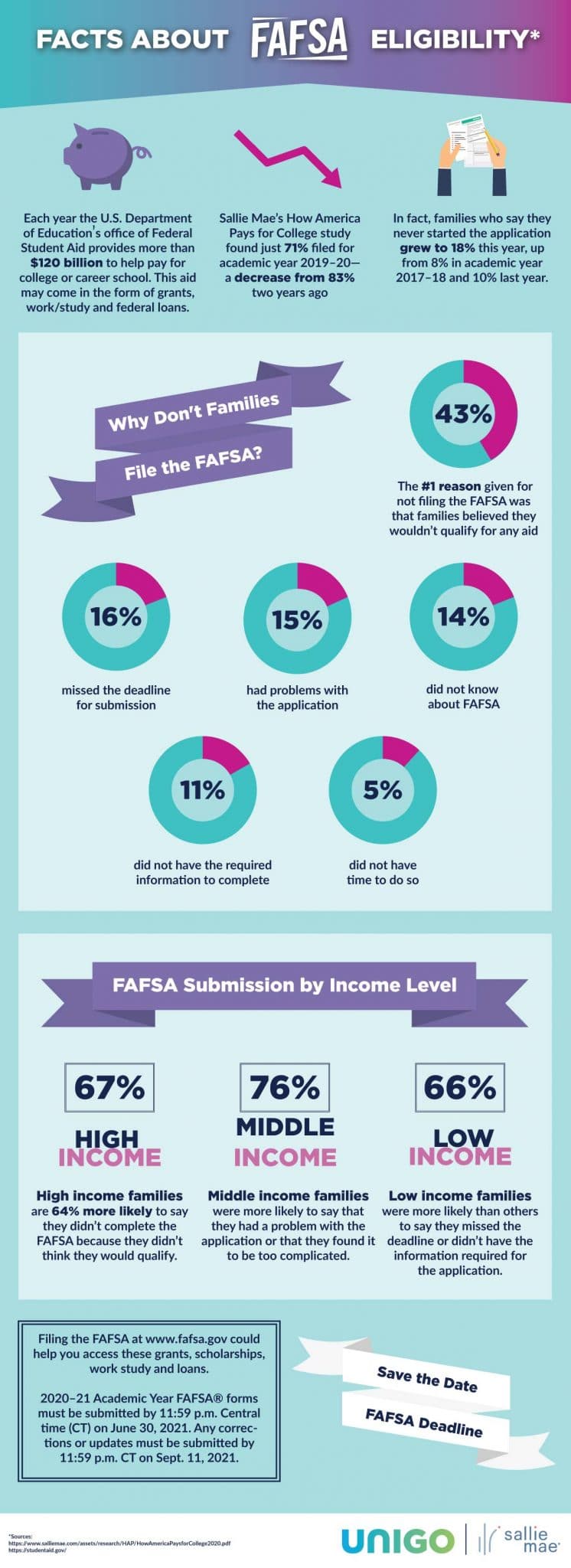

What is the qualifying income for fafsa. Virgin Islands the Republic of the. Parents sometimes wonder whether it is worthwhile to file the Free Application for Federal Student Aid FAFSA especially if they think their income is too high to qualify for need-based financial aidBut there are no simple FAFSA income limits or income cutoffs on financial aid eligibility in part due to the complexity of financial aid formulas. Aid can take the form of scholarships grants loans and work-study jobs.

It is also often pointless to try to hide assets. There is no minimum monthly payment. The income and tax verification regulatory requirements are met if a tax filer who has been granted a filing extension by the IRS provides the institution with the acceptable documentation consistent with the verification documents published in the Free Application for Federal Student Aid FAFSA Information To Be Verified Federal Register.

Need help paying your enrollment fees. Beyond gross income the form asks for your bank account balance investments and recurring expenses. For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero.

The California College Promise Grant CCPG formerly known as the Board of Governors Fee Waiver BOGFW is a state funded program which is available to California residents who meet the specific income eligibility requirements. However you will need to. The Free Application for Federal Student Aidor FAFSAis a form that determines a students financial need level.

The 2023-24 FAFSA will be available for completion on Oct. Federal Student Aid. Students who wish to apply for financial aid must fill out the Free Application for Federal Student Aid FAFSA.

In-kind support is not reported on the FAFSA Financial aid administrators may use professional judgment to include financial support received from the students parents and in-kind support from the parents and other people as untaxed income on Worksheets A and B. The Free Application for Federal Student Aid FAFSA is a free online application you fill out to qualify for federal financial aid. Income-based repayment caps monthly payments at 15 of your monthly discretionary income where discretionary income is the difference between adjusted gross income AGI and 150 of the federal poverty line that corresponds to your family size and the state in which you reside.

Your income your parents financial profile and other information about your family are analyzed to compute your Expected Family Contribution EFC. The income tax return required by the tax code of the Commonwealth of Puerto Rico Guam American Samoa the US. No California College Promise BOGW application.

This helps the FAFSA gather relevant income information that may not otherwise show up on a Federal tax return. To apply complete the online application at the California College Promise Grant page or submit a FAFSA or Dream Act. If you or your parents income is below the minimum amount to file taxes you can choose the option Will not file when you complete the FAFSA.

The FAFSA represents the most important source of documentation used to determine your need for financial-aid during college. If you are a citizen of the Federated States of Micronesia the Republic of the Marshall Islands or. Method C You must have already applied for and been determined to have at least 1104 of financial need by filing a FAFSA or the California Dream Application.

Colleges and universities use FAFSA data to determine whether students are eligible for financial aid from the federal government. This is necessary in order to determine your financial award. Thus a graduate student may be claimed as a dependent on the parents federal income tax return if the student satisfies the IRS rules for a qualifying child without affecting the students status as an independent student for federal student aid purposes.

If parent assets are sufficient to eliminate eligibility for need-based aid usually the parent income on its own is sufficient to prevent the student from qualifying for the Pell Grant and state grants. You can call Selective Service toll-free at 1-888-655-1825 for general information about registering or register online at sssgov or while completing the FAFSA form. Parents do not claim the student as a dependent for income tax purposes.

Package The package includes the FAFSA Simplification Act which makes key changes to the Free Application for Federal Student Aid FAFSA Pell eligibility and the HBCU Capital Financing Program. For qualifying for the simplified or automatic zero EFC calculations the following 2018 income tax forms are considered for a Trust Territory. You or your parents are not required to file a return Those with little or no income have asked if they can pay zero 0 income tax and still submit a FAFSA.

The bill provisions generally take effect on July 1 2023 for award year 2023-24. The child does not have to live with the parent to be considered a dependent on the FAFSA. The need analysis formula is much more heavily weighted toward income than assets.

If applicable has a qualifying account in existence with us at the time the borrower and their co. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC.

Do You Earn Too Much To Qualify For College Financial Aid

Eligibility Requirements Educational Opportunity Fund Stockton University

What Is The Income Limit For Fafsa 2020

Will Your Savings Hurt Your Financial Aid Chances The College Solution

Tactics To Use When Applying For Financial Aid Smith Partners Wealth Management

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

Do My Savings Affect Financial Aid Eligibility Money

How Much Is Too Much Income To Qualify For Financial Aid

Understanding Fafsa How To Qualify For More College Financial Aid Greenbush Financial Group

Do You Earn Too Much To Qualify For College Financial Aid

The Fafsa Divide Getting More Low Income Students To Apply For Aid The Education Trust

Posting Komentar untuk "What Is The Qualifying Income For Fafsa"