What Family Income Qualifies For Financial Aid

However there are a couple big problems with merit aid. Eligibility for the Federal Pell Grant is based on the expected family contribution EFC not income.

If youre a dependent student and your familys annual income if less than 26000 your EFC will be considered zero.

What family income qualifies for financial aid. A family that previously didnt qualify for any financial aid with their first child in college by himself now qualify for up to 48950 between their two children. Should we file a FAFSA if we apply to low-cost schools. For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero.

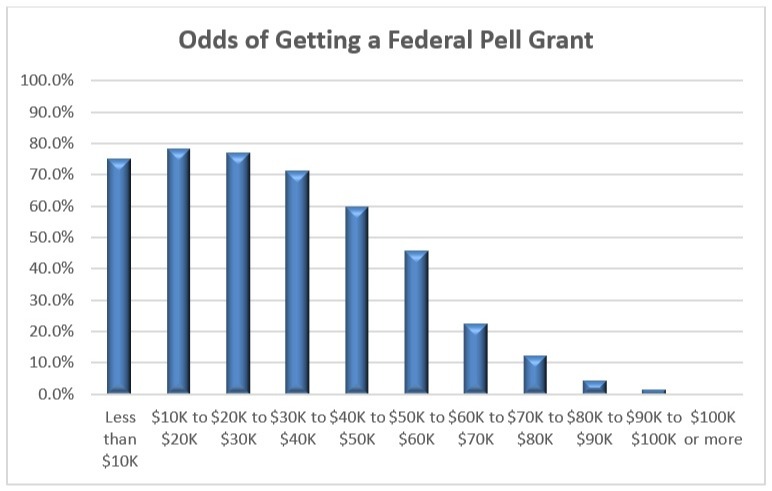

If your family makes less than 30000 a year you likely will qualify for a good amount of Pell Grant funding. 1 Its almost impossible to predict in advance how much one will receive. Private student loan providers often only work with Title IV schools that accept federal aid.

Merit Aid is the money that colleges use to lure their most desirable applicants even if the family does not qualify for need-based aid. For example if two families each have household incomes of 140000 and one familys child attends a state university at a cost of 20000 per year while the other student attends a private. Financial aid comes in many forms and is unique to each situation.

Based on data from the National Postsecondary Student Aid Study NPSAS only 147 of undergraduate students under age. An EFC of zero means that the financial aid formula has determined that the family cannot afford to pay anything towards college. For 2021 if your familys adjusted gross annual income is less than 27000 and your EFC is calculated at zero then you may receive the maximum amount in Pell Grant funding of 6495 per year.

Your financial aid counselor can tell you whether your school offers an eligible career pathway program and can advise you about any ability-to-benefit tests the school uses. Aside from merit aid even high-income families could still qualify for need-based assistance. Major types of financial aid When you complete the Net Price calculator or apply for financial aid you will be eligible for three major types of financial aid.

This may come as a surprise to you but there are no income requirements or cap to the amount of money you can earn to qualify for federal student aid. Students who are independent do not have to supply their parents information and often qualify for more student financial aid as a result. But there is a cap on the earning technically the lowest threshold of income which means your Expected Family Contribution EFC will stand at 0.

Their income limited them initially but this showcases how much certain factors can alter the idea that their income excluded this family from qualifying for financial aid. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC. Thats a mistake to assume you are ineligible said Kalman Chany a financial aid.

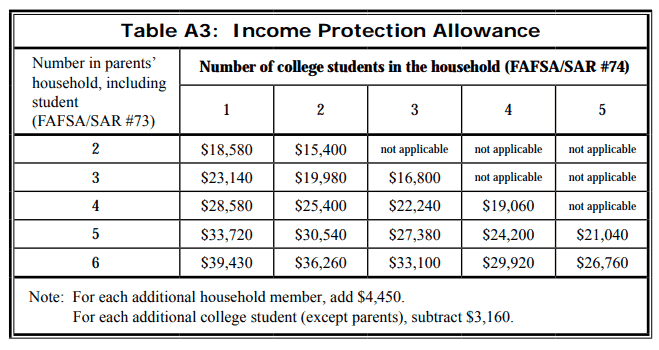

As mentioned above there is no income limit for FAFSA this year. Based on data from the National Postsecondary Student Aid Study NPSAS more than 94 of Federal Pell Grant recipients in 2015-16 had an adjusted gross income AGI under 60000 and 999 had an AGI under 100000. Many factors go into the financial aid equation such as as taxed and untaxed income assets number of children in college and parent age.

In general there must be some type of demonstrated financial need to qualify for certain types of federal financial aid but there is no income cap. For tax filers use the parents adjusted gross income from the tax return to determine if income is 49999 or less. Overall this is a great tool to assess how your family income will impact financial aid at any college or university.

You can determine your Pell Grant funding based on Cost. You or your cosigner typically need to make at least 25000 a year to qualify for a private loan at a minimum. If your family makes between 30000 and 60000 per year you can qualify for some funding but likely not the full amount.

For the 20212022 Award Year an. The EFC for the average American household with an AGI of 55000 will often range from 3000 to 4000. For more information about these criteria talk to the financial aid office at your school.

Families with adjusted gross incomes AGI of 25000 or less have an automatic EFC of 0. For non-tax filers use the income shown on the 2019 W-2 forms of both parents plus any other earnings from work not included on the W-2s to determine if income is 49999 or less. If your family makes 60000 a year or more you will probably not qualify for Pell Grant funding.

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

Understanding Fafsa How To Qualify For More College Financial Aid Greenbush Financial Group

3 Hard Truths About Who Gets Financial Aid

Do You Earn Too Much To Qualify For College Financial Aid

How Much Is Too Much Income To Qualify For Financial Aid

Do My Savings Affect Financial Aid Eligibility Money

Do You Earn Too Much To Qualify For College Financial Aid

Financial Aid Not Just For Low Income Families Morningstar

Posting Komentar untuk "What Family Income Qualifies For Financial Aid"