What Income Is Used To Determine Fafsa

For either tax return use the following to impute their earnings. You might still be eligible to receive financial aid.

Do You Earn Too Much To Qualify For College Financial Aid

Under the Prior Prior FAFSA process the EFC or Expected Family Contribution income numbers are based on the tax year two years prior to submission.

What income is used to determine fafsa. For parents and students the FAFSA utilizes the Adjusted Gross Income AGI figure from the relevant tax return as a starting point for income-related calculations. Since the the 2017-18 school year the FAFSA uses prior-prior years income as base year income. If your or your parents income is less than 27000 your EFC is automatically set at 0.

On your FAFSA you will be asked for work-study earnings so that these can be subtracted from your income. This is a maximum of 4000 but in a two-parent household it can only be claimed if both parents work. Work Study earnings.

On the 2020-21 FAFSA form youll report 2018 tax or calendar year information when asked these questions. If youre filing as a dependent student. To determine a familys financial need the FAFSA asks a series of questions about the parents and students income and assets as well as other factors such.

Im not sure how which percentage is arrived at. The American federal governments FAFSA definition includes three types of student. Distributions from a mutual fund to pay for college will count as income on the FAFSA.

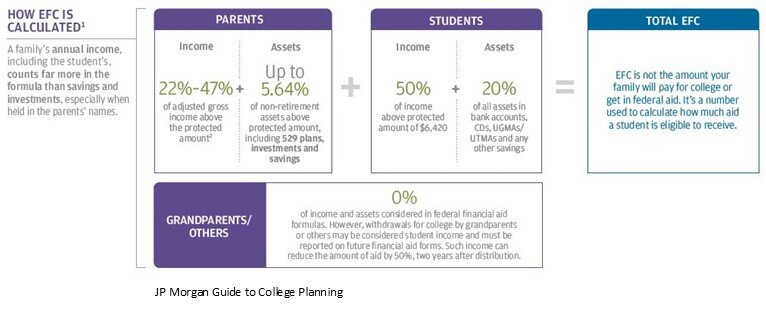

Income information is used to calculate a reasonable percentage of your familys income and assets that can be used to contribute to your students college education which is known as the Expected Family Contribution EFC. In most cases due to the Prior Prior FAFSA families are able to use the data retrieval tool DRT to. Roth IRA or other nontaxable distributions from retirement accounts.

When you fill out the FAFSA form youre automatically applying for funds from your state and possibly from your school in addition to federal student aid. What Does the Income Determine on the FAFSA. And its limited to 35 of the lower income or a maximum of 4000.

The FAFSA weighs parents income much more heavily than parent assets assessing income according to a scale of 22 to 47 percent of available income. Dividends and capital gains that are reported on Form 1040 will also be counted as income on the FAFSA. Its hefty and uncomfortable for most families.

Find specific details that pertain to parents and students. How to answer this question fill out this section. The FAFSA questions about untaxed income such as child support interest income and veterans non-education benefits may or may not apply to you.

This income-related figure comes from your federal tax return and reflects how much you earn minus a few standard deductions. 11500 of income will get the maximum allowance. Between the employment expense allowance and adjustments for taxes that income would add virtually nothing to EFC.

YES these are income and must be reported. NO these are not income. This set of questions asks your parent parents to determine your parents parents overall earnings and income for the year.

This would include but is not limited to their wage earnings. Many factors besides incomesuch as your family size and your year in schoolare considered to determine your aid package. The EFC is calculated based on the parents adjusted gross income AGI which includes all sources of taxable income such as wages taxable.

This is one of many reasons not to use a Roth IRA as your college savings vehicle. As you fill out the FAFSA youll notice that the form requires you to supply your Adjusted Gross Income. The FAFSA considers student income in addition to parent income for dependent students or spousal income for married and therefore independent students.

Records of Your Untaxed Income. For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. The FAFSA considers many factors while determining student financial need more than just income and assets.

The FAFSA takes your parents income and investments into account as well as your own situation in order to determine how much money you will need to go to college. A value of 06 indicates that after the DRT was used and the FAFSA was submitted the student or parent changed an item on the FAFSA eg the date of marriage that would have made the person ineligible to use the DRT. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC.

Your EFC is determined by the answers you provide in the FAFSA form regarding your or your parents income assets family size and the number of family members attending college. So even if your familys income is 250000 and you have assets over a million dollars still apply.

Fafsa Tips For Parents Prep Expert

How To Complete The 2021 2022 Fafsa Application

11 Common Fafsa Mistakes U S Department Of Education

How To Complete The 2021 2022 Fafsa Application

The Fafsa Application Collegechoice

Expected Family Contribution Efc What It Is And How To Calculate It

The Fafsa Application Collegechoice

Reporting Parent Information Federal Student Aid

Taxes Fafsa Efc Financial Literacy Ecpi

11 Common Fafsa Mistakes U S Department Of Education

Expected Family Contribution Efc What It Is And How To Calculate It

Posting Komentar untuk "What Income Is Used To Determine Fafsa"