What Income Do I Need For Fafsa

Both parents and students need this information for the FAFSA form. The FAFSA will want information on available cash balances in savings and checking accounts and any investment portfolios.

Reporting Parent Information Federal Student Aid

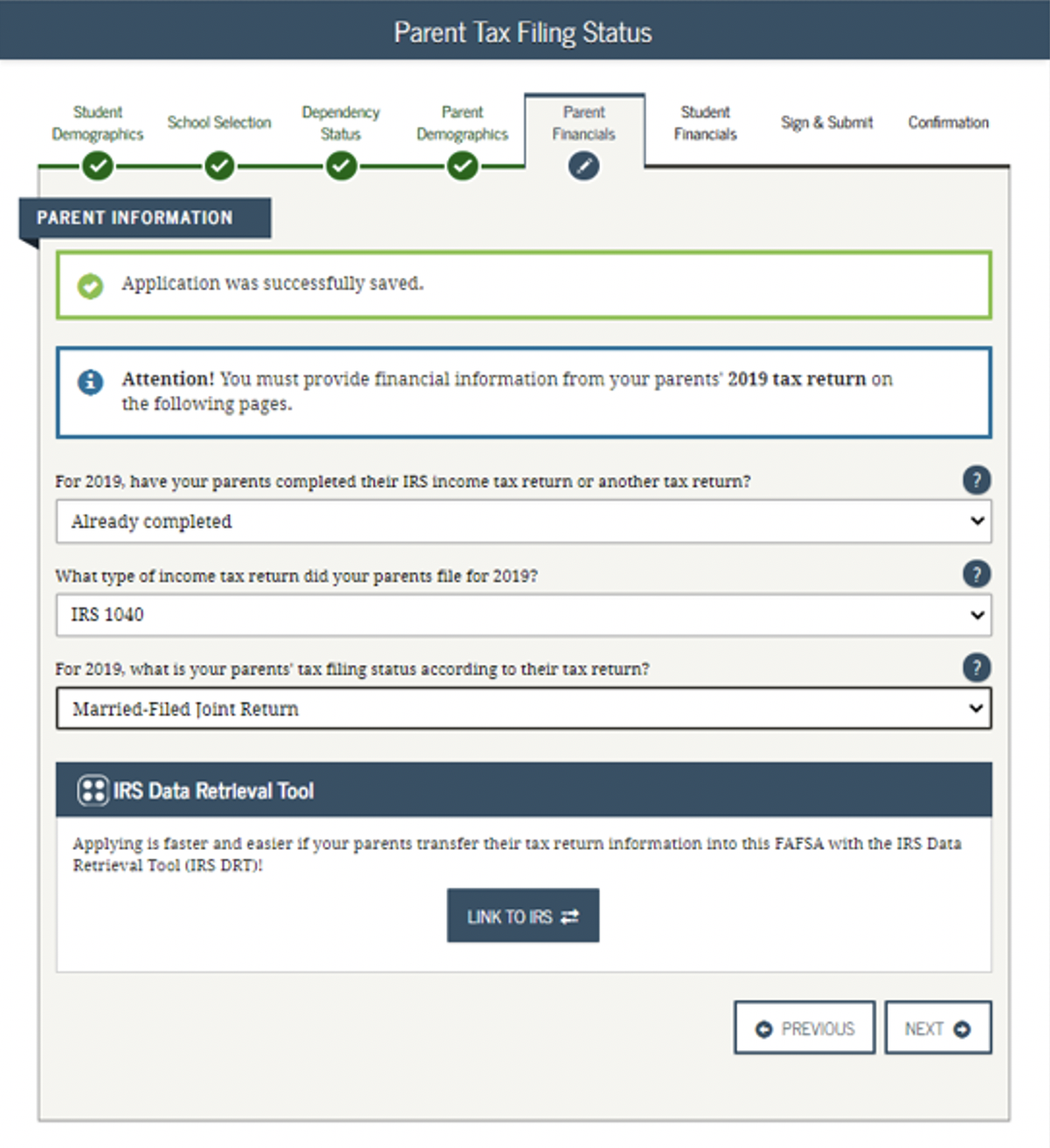

On the 202021 FAFSA form you and your parents if you are a dependent student will report your 2018 income.

What income do i need for fafsa. Some colleges will ask the family to complete a verification worksheet. Although there are no FAFSA income limits there is an earnings cap to achieve a zero-dollar EFC. IRS Form 1040line 1 Schedule.

If you dont have a drivers license dont worry about this step. Your Social Security card and drivers license andor alien registration card if you are not a US citizen. Many factors besides incomesuch as your family size and your year in schoolare considered to determine your aid package.

Return To FAFSA Guide. Child support paid because of. Business income as well as pension and retirement income he said.

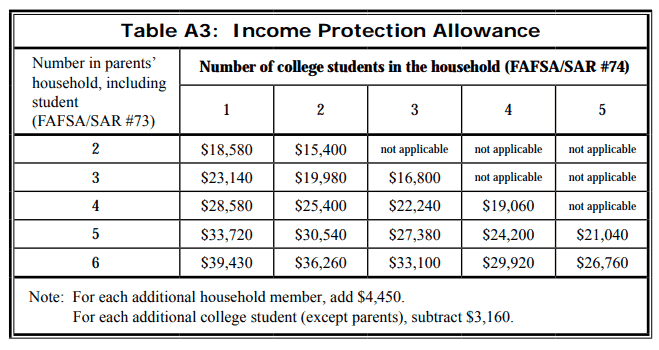

Students 2019 Additional Financial Information Enter the combined amounts for you and your spouse Education credits American Opportunity Tax Credit and Lifetime Learning Tax Credit from IRS Form 1040 Schedule 3 - line 50. Use the information from your Form W-2s to report income earned by the student and parents. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC.

But there are no simple FAFSA income limits or income cutoffs on financial aid eligibility in part due to the complexity of financial aid formulas. Typical documentation might include the familys federal income tax returns andor IRS tax return transcripts proof of income documentation and proof of high school completion such as a high school diploma or GED. Question 86 and 87 ask about earnings wages salaries tips etc in 2019.

For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. What Income Must Be Reported. If you already submitted your FAFSA and then your parents get divorced after that dont panic.

This information may be on the W-2 forms or on the tax return selected in question 80. Your Drivers License Number. Demonstrating financial need The Office of Federal Student Aid uses the information from your FAFSA to determine your financial need.

Since the information you report will then differ from your tax forms youll likely get verified by your college meaning youll just need to provide them with additional documentation like proof of divorce and your primary parents income. Stocks bonds and second homes are all considered investments for the purposes of the FAFSA but your primary home and any small businesses or farms your parent operates do not need to be reported. Your FAFSA Checklist.

Everyone needs to complete this form to be eligible for. How to Answer FAFSA Question 43. In general the wealthier the family the higher the EFC.

Also report other taxable income such as interest income dividends capital gains unemployment compensation and rents. For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. In addition to your parents tax information the FAFSA will ask for a current balance of cash checking savings accounts and investment values.

When you fill out the FAFSA form youre automatically applying for funds from your state and possibly from your school in addition to federal student aid. Your financial need is calculated by subtracting your EFC from your schools cost of attendance. How to Answer FAFSA Question 86-87.

Unless the parents earn more than 350000 a year have only one child and that child will enroll at an in-state public college they should still file the FAFSA as there is a good chance they may qualify for federal state or institutional grants. Business owners do not need to include the employer portion of 401k contributions including to individual 401ks. Demonstrated financial need.

Your federal income tax returns from the prior prior year you dont have to wait - you can use the most recent returns you have from last year W. Answer the questions whether or not a tax return was filed. Employer contributions to retirement accounts.

What is the income limit for fafsa 2020. Even though a portion of most 529 plan distributions is untaxed income it does not need to be reported for FAFSA purposes. Student Additional Financial Information.

A wide range of EFCs exists. Your 2018 Tax Records. The FAFSA uses your adjusted gross income so the income you report will be reduced by any IRS-allowable adjustments such as payments to an IRA or half of the self-employment tax.

The FAFSA asks about income as well as assets. 35000 In this case the student would be eligible for up to 35000 in need-based aid from the private college because the price of the institution far exceeds the familys EFC. FAFSA also requests information on any untaxed income.

How Much Is Too Much Income To Qualify For Financial Aid

Do You Earn Too Much To Qualify For College Financial Aid

Filling Out The Fafsa Form Federal Student Aid

Federal Income Tax Form Simplification Complicates Fafsa Form

Vernon College Fafsa It S Really Not That Difficult

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

Money Under 30 S Guide To Filling Out The Fafsa Money Under 30

True Or False You Can Fill Out Your Fafsa Before Filing Taxes U S Department Of Education

How To Complete The 2021 2022 Fafsa Application

Filling Out The Fafsa Form Federal Student Aid

Do You Earn Too Much To Qualify For College Financial Aid

Posting Komentar untuk "What Income Do I Need For Fafsa"