What Income Do I Use For Fafsa

Some families are eligible to have the entirety of their incomes excluded from consideration by the FAFSA methodology. Most people qualify for some type of financial aid including low-interest federal student loans.

Vernon College Fafsa It S Really Not That Difficult

It doesnt matter if you have a low or high income.

What income do i use for fafsa. This puts both the students and parents in an advantageous position as they will be able to complete FAFSA as early as possible. The EFC is calculated based on the parents adjusted gross income AGI which includes all sources of taxable income such as wages taxable. Who Is the Custodial Parent.

All real estate holdings other than the house you live in must be listed as well as any business or farm assets. On the 2020-21 FAFSA form youll report 2018 tax or calendar year information when asked these questions. You only include the income of your custodial parent which includes any alimony andor child support paid by the noncustodial parent.

This means on FAFSA 202122 the 2019 income will be reported not 2020. You can determine your EFC by using the free online. If they did not file taxes they will need to enter the figures in Boxes 1 8 on their W-2 statement.

Once the income is above 100K roughly 15th to 14th of income will be counted towards your EFC. That can get confusing but fortunately here is the answer. Parents income taxes.

Combat pay or special combat pay. While income is a factor for some financial aidyoull need to show exceptional financial need in order to qualify for a Pell Grant for exampleyou or your familys income isnt a factor when. Use Lines 7 12 18 Box 14 of IRS Schedule K-1 Form 1065 IRS Form 1040A.

Will fafsa cover my entire tuition. This is a maximum of 4000 but in a two-parent household it can only be claimed if both parents work. Your familys Adjusted Gross Income and assets minus specified allowances equals your expected family contribution EFC.

The FAFSA Free Application for Federal Student Aid asks for detailed financial information from both yourself and your parents. The reality is theres no income cut-off to qualify for federal student aid. The FAFSA will want information on available cash balances in savings and checking accounts and any investment portfolios.

The parent income protection allowance for the same year ranges between 18580 and 39430 depending on the size of the household and number of family members in college. Only enter the amount that was taxable and included in your adjusted. Even if you complete FAFSA form after you file your 2020 tax return you will need to use the 2019 tax return you filed in 2020.

Parents are not expected to use retirement money for college costs and as parent age rises your EFC decreases. It assumes that your parents will help you pay for college even though this isnt the case for every student. But who is your custodial parent.

Between the employment expense allowance and adjustments for taxes that income would add virtually nothing to EFC. The EFC for this household was roughly 42000. Records of Your Untaxed Income.

When it comes to reporting income parents should never list their 401K plan. The American federal governments FAFSA definition includes three types of student. For either tax return use the following to impute their earnings.

The FAFSA switched from prior-year income to prior-prior-year income starting with the 2017-2018 FAFSA for several reasons. And its limited to 35 of the lower income or a maximum of 4000. Includes AmeriCorps benefits awards living allowances and interest accrual payments as well as grant and scholarship portions of fellowships and assistantships.

How much income is too much for fafsa. The FAFSA questions about untaxed income such as child support interest income and veterans non-education benefits may or may not apply to you. Students adjusted gross income.

For any amount above your income protection allowance roughly every 10000 in extra income lowers your financial aid qualification by another 3000. Use of the prior-prior year allows the FAFSA to be based on federal income tax returns that have already been filed as opposed to estimating income. Use the information from your Form W-2s to report income earned by the student and parents.

In fact students are expected to put 50 of their earnings towards paying for school. The FAFSA takes your parents income and investments into account as well as your own situation in order to determine how much money you will need to go to college. The FAFSA uses a standardized form to ensure that every applicant has the same criteria for calculating income and assessing need-based aid.

750 I didnt use retirement assets in this calculation because the EFC formulas exclude them. 11500 of income will get the maximum allowance. The 2020-21 FAFSA form requires only 2018 tax information.

How To Complete The 2021 2022 Fafsa Application

Do You Earn Too Much To Qualify For College Financial Aid

Money Under 30 S Guide To Filling Out The Fafsa Money Under 30

How Much Is Too Much Income To Qualify For Financial Aid

How To Complete The 2021 2022 Fafsa Application

11 Common Fafsa Mistakes U S Department Of Education

How To Complete The 2021 2022 Fafsa Application

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

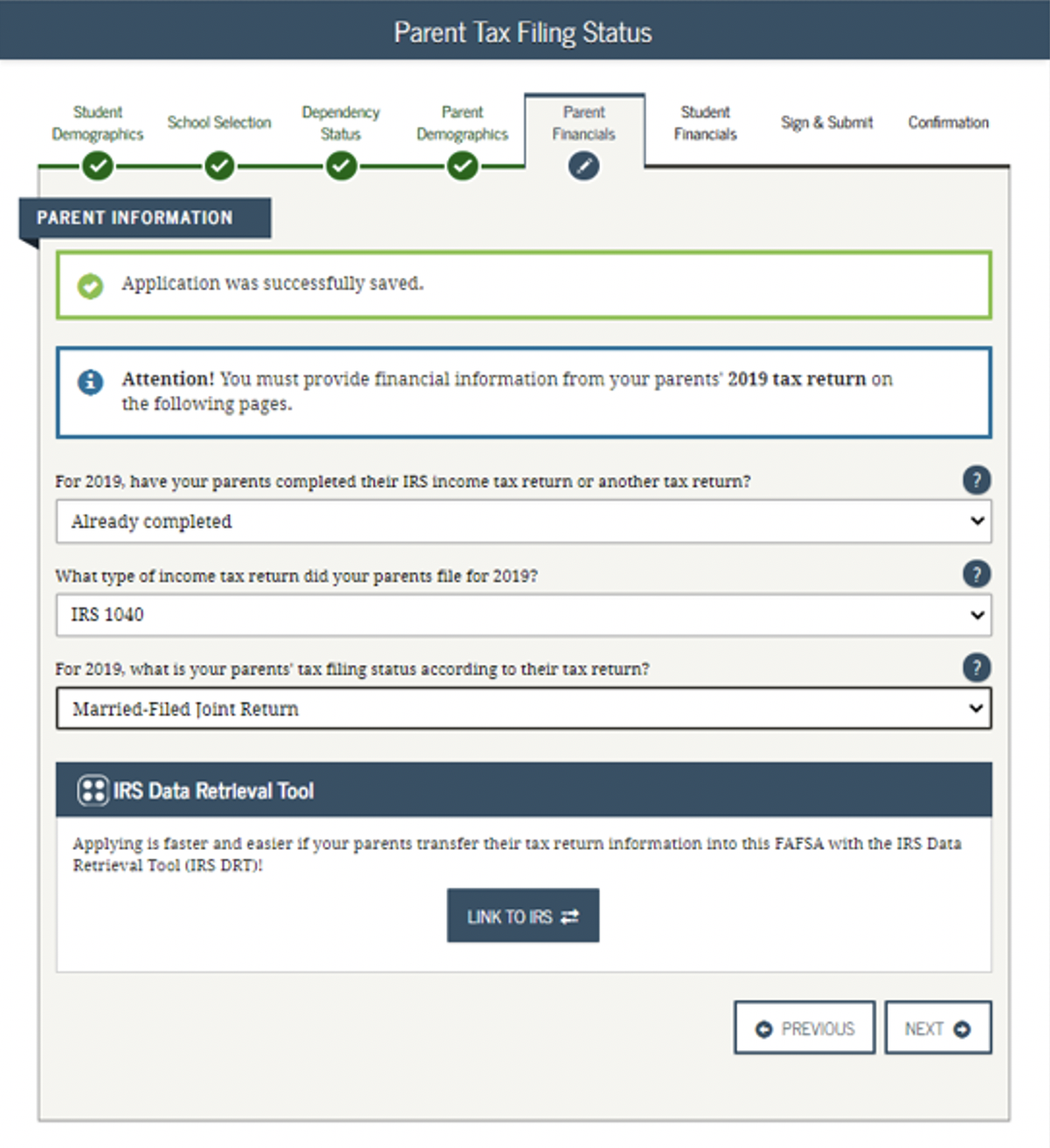

Reporting Parent Information Federal Student Aid

Whose Income Do I Report On My Fafsa Get Schooled

Fafsa Basics Parent Income The College Financial Lady

Posting Komentar untuk "What Income Do I Use For Fafsa"