What Is The Income To Qualify For Financial Aid

Financial aid comes in many forms and is unique to each situation. 35000 In this case the student would be eligible for up to 35000 in need-based aid from the private college because the price of the institution far exceeds the familys EFC.

Do You Earn Too Much To Qualify For College Financial Aid

Complete Guide to Financial Aid and the FAFSA.

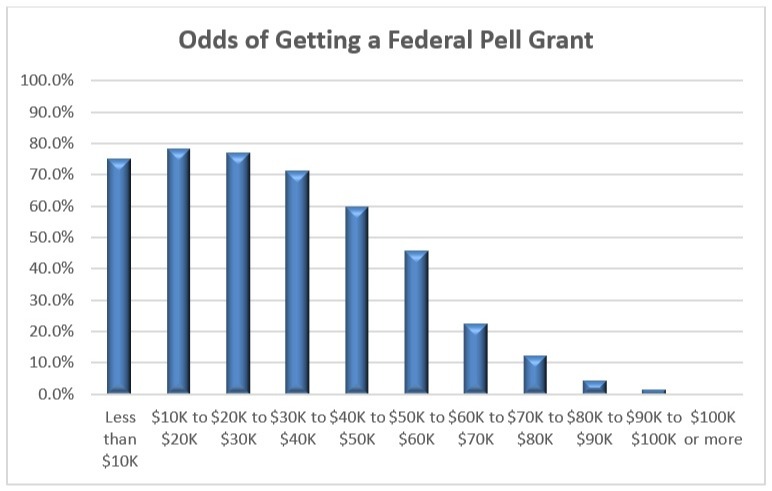

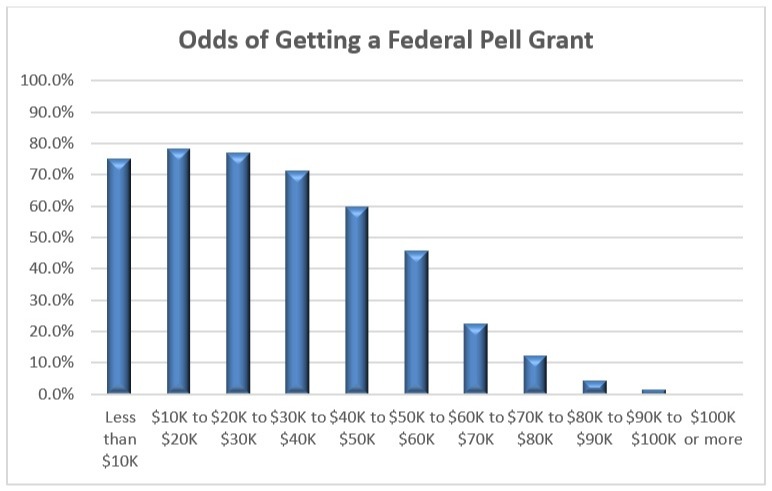

What is the income to qualify for financial aid. A wide range of EFCs exists. What is the Maximum Income to Qualify for Financial Aid. Based on data from the National Postsecondary Student Aid Study NPSAS more than 94 of Federal Pell Grant recipients in 2015-16 had an adjusted gross income AGI under 60000 and 999 had an AGI under 100000.

The maximum Pell Grant is 6095 for the 201819 award year July 1 2018 to June 30 2019. For example if two families each have household incomes of 140000 and one familys child attends a state university at a cost of 20000 per year while the other student attends a private. Most Pell Grant recipients make less than 50000 per year.

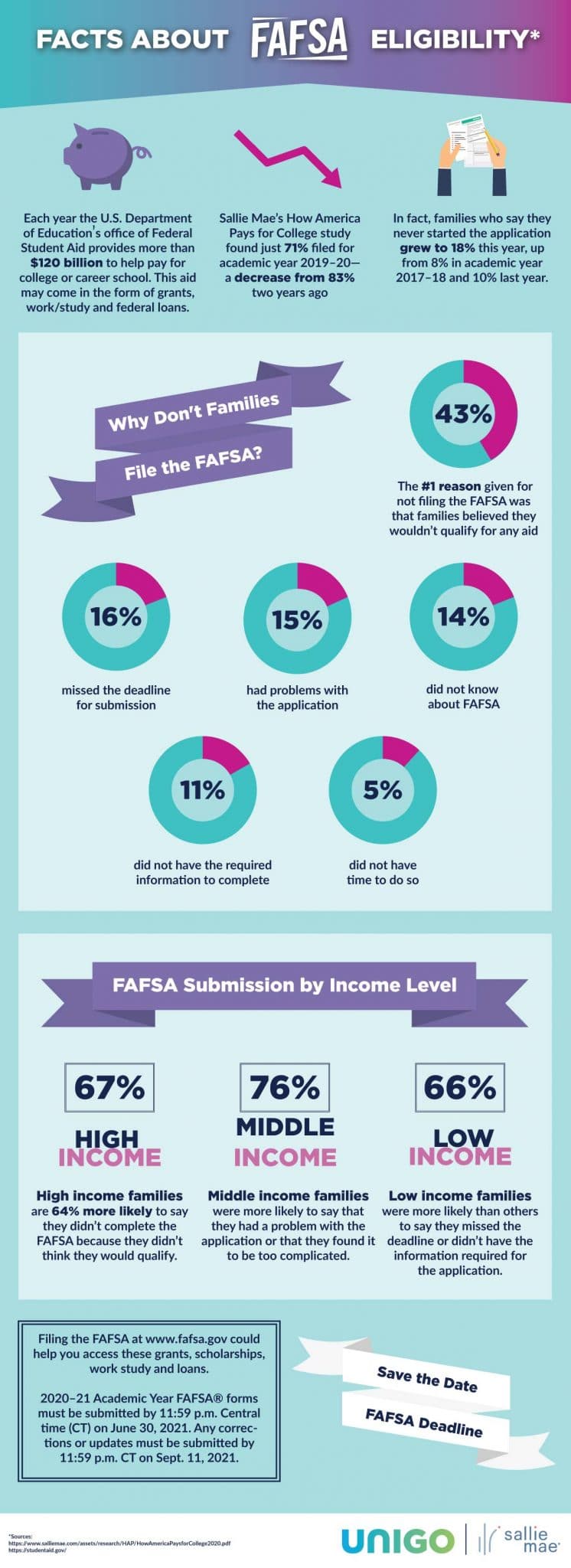

If parents have a single child and their income is below 350000 a year there is a good chance that their kids will get qualified for this given they have filled out the FAFSA application. You can be extremely wealthy and still qualify for these loans. Financial aid can come from your college federal programs state programs and even private sources.

In general there must be some type of demonstrated financial need to qualify for certain types of federal financial aid but there is no income cap. The Hope Scholarship tax credit is available to families with income up to 90000 single filers and 180000 married filing joint. Every college will calculate financial aid according to their own unique formula.

There are more eligibility requirements you must meet to qualify for federal student aid. Citizen or eligible noncitizen and are enrolled in an eligible degree or certificate program at your college or career school. How much federal aid am I eligible to receive.

Your financial need is calculated by subtracting your EFC from your schools cost of attendance. The major reason that there is no income limit to apply for financial aid is because financial aid is very complex. Our general eligibility requirements include that you have financial need are a US.

For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. 60000 cost of attendance ¼ 162000 405002 20250 39750 financial aid qualification Here we can see how not only more kids in college can help qualify for more financial aid but how the cost of the school selected can greatly alter your financial aid qualification. That means that you can expect to receive a different financial aid.

Financial aid qualification Child 2. Financial aid includes grants scholarships student loans and the work-study program. Many free need-based options.

As told above the amount of federal grant depends on family income and a few other factors. Like the Pell Grant this honor is part per semester. Even if you dont have financial need its still worth submitting the FAFSA to access low-rate federal student loans which youll learn more about below.

Eligibility for the Federal Pell Grant is based on the expected family contribution EFC not income. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC. There is no maximum income to receive financial aid.

But even if your family does have greater resources you should still submit the FAFSA. Financial aid is money to help you pay for college. That depends on factors.

But if you do have financial need you could additionally qualify for need-based aid. Be mindful that even if you qualify for need-based financial aid you might not receive enough to cover college costs. For 2021 if your familys adjusted gross annual income is less than 27000 and your EFC is calculated at zero then you may receive the maximum amount in Pell Grant funding of 6495 per year.

Not all schools take an interest in this program. For one thing the Pell Grant is not the only form of federal aid - federal loans for example can. Government cash goes to taking interest in schools and colleges for the Federal Supplementary Education Opportunity Grant FSEOG which can give you somewhere in the range of 100 and 4000 every year contingent upon your money related need.

However you might have trouble qualifying for programs that consider need if your family brings in over 250000 a year. Demonstrated financial need. Note that student employment can have a big impact on.

In general the wealthier the family the higher the EFC. You can determine your Pell Grant funding based on Cost.

The Fafsa Divide Getting More Low Income Students To Apply For Aid The Education Trust

How To Increase Your Chances Of Getting College Aid Marketwatch

Will Your Savings Hurt Your Financial Aid Chances The College Solution

How Much Is Too Much Income To Qualify For Financial Aid

How Much Is Too Much Income To Qualify For Financial Aid

2014 Guide To Fafsa Css Profile College Aid And Expected Family Contribution

Middle Class Often Left Out Of College Financial Aid The Bruin Voice

Do I Make Too Much To Qualify For Financial Aid Greenbush Financial Group

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

Do My Savings Affect Financial Aid Eligibility Money

Posting Komentar untuk "What Is The Income To Qualify For Financial Aid"