What Is Maximum Income To Qualify For Financial Aid

Youll provide details about your financial situation and family circumstances to verify your need and eligibility for financial aid. For private schools tuition and fees average 32410.

Fafsa For 2021 Income Limits Aid Types And More Student Loan Hero

But next year when the students sibling is also enrolled the parent contribution is split in half.

What is maximum income to qualify for financial aid. You can determine your Pell Grant funding based. For any amount above your income protection allowance roughly every 10000 in extra income lowers your financial aid qualification by another 3000. The major reason that there is no income limit to apply for financial aid is because financial aid is very complex.

If parents have a single child and their income is below 350000 a year there is a good chance that their kids will get qualified for this given they have filled out the FAFSA application. There is no stated maximum income to qualify for financial aid. Unless the parents earn more than 350000 a year have only one child and that child will enroll at an in-state public college they should still file the FAFSA as there is a good chance they may qualify for federal state or institutional grants.

Many families assume they wont qualify for financial aid and dont even bother to apply. In fact there is no income cutoff for eligibility. The EFC for the average American household with an AGI of 55000 will often range from 3000 to 4000.

Some types of financial aid require you to show financial need like direct subsidized loans while others such as direct unsubsidized loans do not. To get federal direct student loans for instance you must be enrolled in school at least half-time. As told above the amount of federal grant depends on family income and a few other factors.

The FAFSA application uses a complex need analysis formula to evaluate income number of people in the household and in college age of the eldest parent investments cash savings checking and. Fortunately the household income can be reduced by ongoing care and medical costs to meet the income test under certain conditions which we will discuss below. With college expenses of 19000 a year the student will have a financial need of 2000 and will probably not be eligible for much financial aid.

For the 201920 academic year the maximum amount you can receive from a Pell Grant is 6195. There is no specific income limit. Every college will calculate financial aid according to their own unique formula.

Pell Grant Income Limits There is no hard and fast income limit for receiving a Pell Grant. The key to receiving a. If you fall below specific income levels you can qualify for the maximum each year.

Every college student is encouraged to apply for federal aid through the FAFSA and your parents income level will have no bearing on some available aid. The student income allowance is 6660. Household size age of parents and the number of students in college affect aid eligibility as well as any extenuating financial circumstances.

What is the income limit to qualify for financial aid. For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC.

Once the income is above 100K roughly 15th to 14th of income will be counted towards your EFC. In general there must be some type of demonstrated financial need to qualify for certain types of federal financial aid but there is no income cap. These families have significant financial aid needs.

Households earning as much as 5000 a month or more might still qualify even though this current income is greater than the MAPR. But there are no simple FAFSA income limits or income cutoffs on financial aid eligibility in part due to the complexity of financial aid formulas. Additionally when thinking in terms of income as a student contributing to his or her education for the 2018-2019 academic year a student can make up to a particular amount of non-work-study taxable or untaxable income before it is counted as income and used in calculating your financial aid package.

What is the Maximum Income to Qualify for Financial Aid. Families with adjusted gross incomes AGI of 25000 or less have an automatic EFC of 0. With the cost of the most expensive colleges today now in excess of 65000 per year even students from families with incomes over 200000 can qualify for need-based aid.

Financial aid comes in many forms and is unique to each situation. To receive any type of federal financial aid you must submit the FAFSA. Household income does however restrict certain financial aid types such as Pell Grants and other need-based awards.

For 2021 if your familys adjusted gross annual income is less than 27000 and your EFC is calculated at zero then you may receive the maximum amount in Pell Grant funding of 6495 per year. For students who havent earned lucrative scholarships need-based financial aid can play a vital role. That means that you can expect to receive a different financial aid.

How Much Is Too Much Income To Qualify For Financial Aid

Do You Earn Too Much To Qualify For College Financial Aid

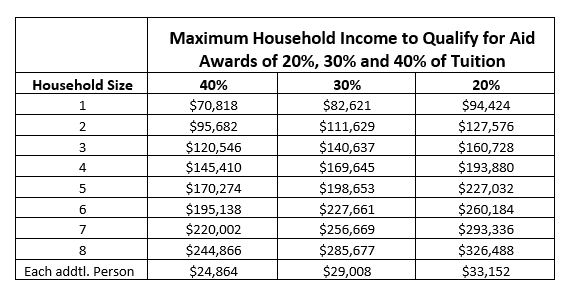

Financial Aid For Hbms Hoff Barthelson Music School

Financial Aid The Maine School Of Science And Mathematics

What Is The Maximum Income To Qualify For Fafsa 2019

Do My Savings Affect Financial Aid Eligibility Money

Financial Aid Eligibility Federal Student Aid

What Is The Income Limit For Fafsa 2020

What Is The Maximum Income To Qualify For Financial Aid

Do You Earn Too Much To Qualify For College Financial Aid

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

Posting Komentar untuk "What Is Maximum Income To Qualify For Financial Aid"