What Is The Income Eligibility For Financial Aid

The FAFSA application uses a complex need analysis formula to evaluate income number of people in the household and in college age of the eldest parent investments cash savings checking and even the state of legal residence. This upper threshold is where an applicant has a gross monthly income.

Do My Savings Affect Financial Aid Eligibility Money

But there are no simple FAFSA income limits or income cutoffs on financial aid eligibility in part due to the complexity of financial aid formulas.

What is the income eligibility for financial aid. National or permanent resident and have a valid Social Security number. What is the income limit to qualify for financial aid. Financial aid comes in many forms and is unique to each situation.

Anna Helhoski Oct 21 2020 Many or all of the products featured here are from our. Household size age of parents and the number of students in college affect aid eligibility as well as any extenuating financial circumstances. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC.

Families with adjusted gross incomes AGI of 25000 or less have an automatic EFC of 0. What is the Maximum Income to Qualify for Financial Aid. In general there must be some type of demonstrated financial need to qualify for certain types of federal financial aid but there is no income cap.

Customers initially applying must meet the 200 FPG Initial Eligibility income requirement to receive financial assistance for child care. There is no specific income limit. The major reason that there is no income limit to apply for financial aid is because financial aid is very complex.

For a single surviving spouse the basic MAPR in 2020 is 9224 and the deductible is 461. To be eligible for Part-time TAP you must have been a first-time freshman in the 2006-07 academic year or thereafter have earned 12 credits or more in each of. The gross income test is an upper threshold above which an applicant will not be financially eligible for civil legal aid.

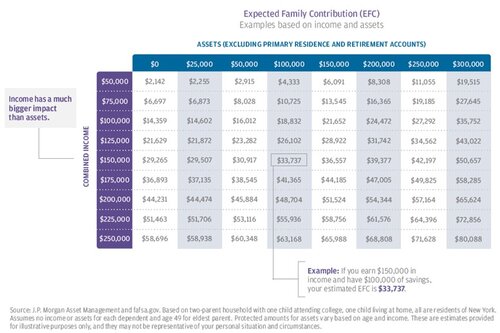

The EFC for the average American household with an AGI of 55000 will often range from 3000 to 4000. Federal grants are determined by the federal government and do not have to be paid back. Private student loan providers often only work with Title IV schools that accept federal aid.

Everyone is eligible for some kind of financial aid for college but not everyone qualifies for need-based aid. You provide this information. Unless the parents earn more than 350000 a year have only one child and that child will enroll at an in-state public college they should still file the FAFSA as there is a good chance they may qualify for federal state or institutional grants.

If parents have a single child and their income is below 350000 a year there is a good chance that their kids will get qualified for this given they have filled out the FAFSA application. At minimum you must. An EFC of zero means that the financial aid formula has determined that the family cannot afford to pay anything towards college.

As told above the amount of federal grant depends on family income and a few other factors. A portion of student income is sheltered from the financial aid formula but as much as half of income. It is common for people to think they make too much money to qualify for financial aid.

Citizen or an eligible noncitizen including a US. Have a high school diploma or GED certificate. Claimants qualifying on income alone without a rating for aid and attendance or housebound typically need to make such little money they are likely below the poverty level.

Note that student employment can have a big impact on aid eligibility especially for independent students. For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. Institutional grants are given by the school state or other private.

Need-based financial aid may include grants that you dont have to repay work-study employment to help defer college costs and subsidized loans. What is the Maximum Income to Qualify for Different Types of Financial Aid. Before you skip the FAFSA learn more about the basics and the truth about income requirements.

You or your cosigner typically need to make at least 25000 a year to qualify for a private loan at a minimum. Income eligibility limits are set in TWIST. But the truth is most people qualify for some financial aid so its always a good idea to complete the Free Application for Federal Student Aid FAFSA each year your child is in college.

At recertification a customers income cannot exceed the 85 SMI sustaining income limits to continue receiving financial assistance for child care. The Hope Scholarship tax credit is available to families with income up to 90000 single filers and 180000 married filing joint. How financial aid is calculated.

Every college will calculate financial aid according to their own unique formula. That means that you can expect to receive a different financial aid package at every college you are accepted to. Start by reviewing and understanding the basic eligibility criteria for federal financial aid.

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

Fafsa Eligibility Guide To Qualify And Apply For Federal Student Aid

How Much Is Too Much Income To Qualify For Financial Aid

Do You Earn Too Much To Qualify For College Financial Aid

Fafsa For 2021 Income Limits Aid Types And More Student Loan Hero

What Is The Maximum Income To Qualify For Financial Aid

Financial Aid Eligibility Federal Student Aid

Understanding Fafsa How To Qualify For More College Financial Aid Greenbush Financial Group

Financial Aid Application Is Simpler And Available Earlier But No Panacea

Do You Earn Too Much To Qualify For College Financial Aid

Posting Komentar untuk "What Is The Income Eligibility For Financial Aid"