What Income Is Required For Fafsa

On your FAFSA you will be asked for work-study earnings so that these can be subtracted from your income. The FAFSA requires that you provide the marital status as of today so that they know your status going into the new school year.

Do You Earn Too Much To Qualify For College Financial Aid

As mentioned above there is no income limit for FAFSA this year.

What income is required for fafsa. Records of Your Untaxed Income. Thus there are no clear FAFSA income limits. You do not owe money on a federal student grant and.

The EFC is calculated based on your Adjusted Gross Income AGI and other income sources and schools use it. The IRS Information Recovery instrument can be utilized to drag exact data straightforwardly from the IRS from charges that have as of now been filed. Since applications for the FAFSA 202122 Award Year begins on October 1 2020 parents should have filed their taxes by then.

But there is a cap on the earning technically the lowest threshold of income which means your Expected Family Contribution EFC will stand at 0. Income Tax Mean On Fafsa. You will use federal student aid only for educational purposes.

What Does the Income Determine on the FAFSA. There are some criteria of income tax for fafsa and as follows. Many factors go into the financial aid equation such as as taxed and untaxed income assets number of children in college and parent age.

For Fafsa income tax is not all of your salary that is the income that goes into your home. YES these are income and must be reported. Also report other taxable income such as interest income dividends capital gains unemployment compensation and rents.

Students whose families have a total income of up to 50000 may be eligible for the need-based funding though most Pell grant money goes to students with a total family income below 20000. Combat pay or special combat pay. What qualification do you need to work in childcare.

The tax information required on the FAFSA can be found on the first two pages of the 1040 or 1040A document your parent used to file their FAFSA. Should we file a FAFSA if we apply to low-cost schools. For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero.

Having a high school diploma or a recognized equivalent such as a General Educational Development GED certificate. Some families are eligible to have the entirety of their incomes excluded from consideration by the FAFSA methodology. Keep a copy of these documents in case you need them later.

To make the process easier your parent will have the option of using the IRS Data Retrieval Tool to link your FAFSA to their IRS tax filings. You still need to report your marital status as of the day you filled out the FAFSA. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC.

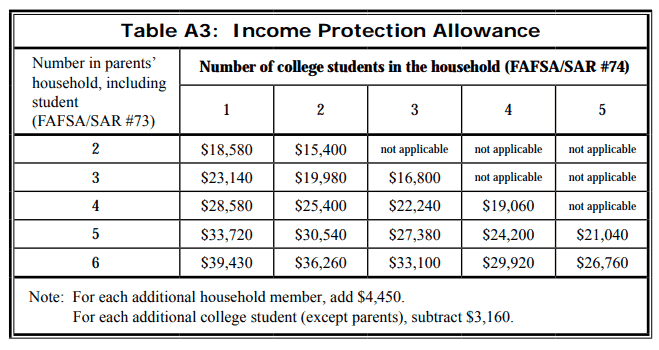

The parent income protection allowance for the same year ranges between 18580 and 39430 depending on the size of the household and number of family members in college. Roth IRA or other nontaxable distributions from retirement accounts. Do not enter untaxed combat pay.

The Free Application for Federal Student Aid FAFSA is based on income and tax information from the prior-prior year federal income tax return current asset information and current demographic information. Gathering certain documents in advance will make filing the FAFSA easier. This means on FAFSA 202122 the 2019 income will be reported not 2020.

On the 2020-21 FAFSA form youll report 2018 tax or calendar year information when asked these questions. The FAFSA questions about untaxed income such as child support interest income and veterans non-education benefits may or may not apply to you. Eligibility for need-based financial aid depends on more than just income.

Only enter the amount that was taxable and included in the parent adjusted gross income. The FAFSA uses your adjusted gross income so the income you report will be reduced by any IRS-allowable adjustments such as payments to an IRA or half of the self-employment tax. Papetti said filing the simple form or Schedule 1 does not have any impact on the information you are required to provide when completing the FAFSA.

If youre a dependent student and your familys annual income if less than 26000 your EFC will be considered zero. In addition to income the FAFSA requests. Even if you the parent of the student havent filed a tax return by then due to an extension you will have 15 more days to file your 2019 tax return.

Income information is used to calculate a reasonable percentage of your familys income and assets that can be used to contribute to your students college education which is known as the Expected Family Contribution EFC. While this might not match the tax or income status that is on your tax return it doesnt matter. Includes AmeriCorps benefits awards living allowances and interest accrual payments as well as grant and scholarship portions of fellowships and assistantships.

Completing a high school education in. Show youre qualified to obtain a college or career school education by. This may come as a surprise to you but there are no income requirements or cap to the amount of money you can earn to qualify for federal student aid.

The 2020-21 FAFSA form requires only 2018 tax information.

How Much Is Too Much Income To Qualify For Financial Aid

Financial Aid Eligibility Federal Student Aid

Fafsa For 2021 Income Limits Aid Types And More Student Loan Hero

Reporting Parent Information Federal Student Aid

Fafsa Eligibility Guide To Qualify And Apply For Federal Student Aid

Vernon College Fafsa It S Really Not That Difficult

Taxes Fafsa Efc Financial Literacy Ecpi

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

Do I Make Too Much To Qualify For Financial Aid Greenbush Financial Group

Do You Earn Too Much To Qualify For College Financial Aid

The Fafsa Divide Getting More Low Income Students To Apply For Aid The Education Trust

Posting Komentar untuk "What Income Is Required For Fafsa"