What Year Taxes Do I Need For Fafsa 2020-21

Variable interest rates will fluctuate over the term of the loan with changes in the LIBOR rate and will vary based on applicable terms level of degree and presence of a co-signer. 2020-21 FAFSA - 2018 tax information.

Reporting Parent Information Federal Student Aid

Aside from the time it takes.

What year taxes do i need for fafsa 2020-21. Cash savings and checking account balances. Your FSA ID login information. If you or your parents have missed the 2018 tax filing deadline of April 2019 and still need to file a 2018 income tax return with the Internal Revenue Service IRS you should submit your FAFSA form now using estimated tax information and then you must correct that information after you file your return.

Records of untaxed income. Use of the prior-prior year allows the FAFSA to be based on federal income tax returns that have already been filed as opposed to estimating income and tax information. Academic School Year.

For that reason its important to complete your FAFSA well ahead of the annual filing deadline. M Your Social Security number. M Email address or mobile phone number.

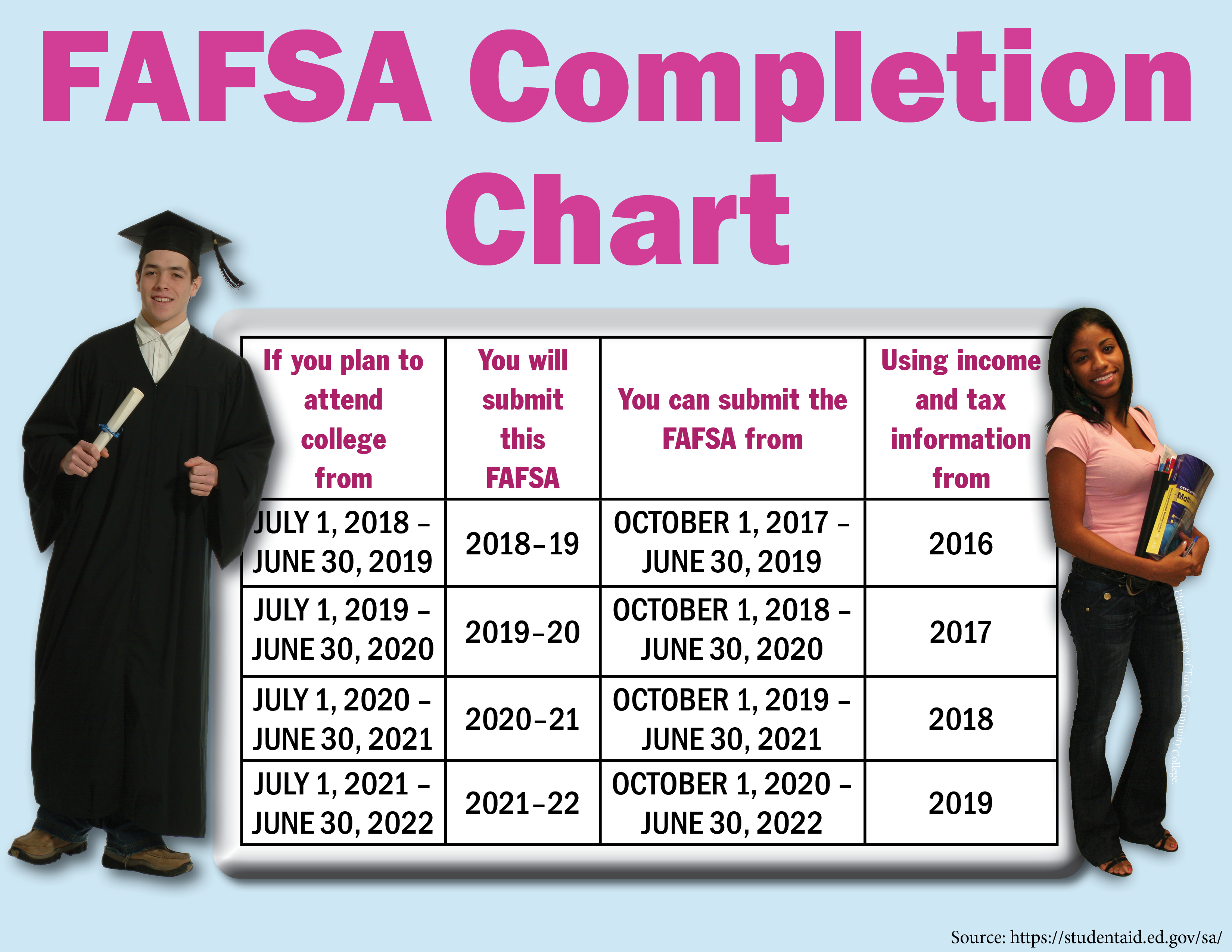

September 21 2020 The Free Application for Federal Student Aid FAFSA bases income and tax information on a specific years federal income tax returns the prior-prior year. The maximum variable rate is the greater of 2100 or Prime Rate plus 900. Starting with the 2017-2018 form the FAFSA now requires tax information from two years earlier called the prior prior year In other words for the 2020-2021 FAFSA youll provide 2018 tax.

Dont forget that students need to complete the FAFSA every year they are attending school. 20212022 FAFSA Completion Guide Need help. Your Social Security Number or Alien Registration Number.

The 2021-2022 Free Application for Federal Student Aid called the FAFSA looks similar to last years form with some small tweaks. Best of all the FAFSA is free. For the 2021-22 academic year FAFSAs were accepted starting Oct.

Call Federal Student Aid at 8004333243 What you will need. Even if you the parent of the student havent filed a tax return by then due to an extension you will have 15 more days to file your 2019 tax return. What year taxes do I need for fafsa 2020 21.

If youre applying for financial aid for the 20202021 academic school year file a 20202021 FAFSA form which is based on 2018 income tax returns. 1 2020 and must be received by June 30 2022. For the 202021 FAFSA filers will use their 2018 tax returns.

Use the IRS Data Retrieval Tool when possible to automatically import your tax information into your FAFSA. So just because you received a great financial aid package freshmen year dont get lazy and forget to send that FAFSA in again in October of your first year for next years aid package. The 2021-22 FAFSA will use 2019 income and tax information for students and parents.

Unfortunately the changes could be detrimental to the amount of financial aid students receive mostly due to the 2018 tax reform and how it changed the tax forms needed to file. For the 2020-21 academic year FAFSAs were accepted starting Oct. 2021-22 FAFSA - 2019 tax information.

You cannot substitute income and tax information from a more recent year even if the information is available. If you filled out the 201920 FAFSA you still need to complete the 202021 FAFSA if you want aid for the 202021 school year. This year FAFSA made two changes that could affect how you file and how much financial aid you could get.

Use Tax Year Data. What year of income do I need to report on my FAFSA. Why is fafsa based on 2 years ago.

M Your alien registration number if you are not a US. 1 2019 and must be received by June 30 2021. George Fox Universitys school code.

Since applications for the FAFSA 202122 Award Year begins on October 1 2020 parents should have filed their taxes by then. M FSA ID for the student and the dependent both students parentstepparent. As of June 1 2021 the one-month LIBOR rate is 009.

Into their FAFSA form. If youre applying for financial aid for the 20212022 school year you should file a 20212022 FAFSA form which is based on 2019 income tax returns.

What To Know About Filing The 2021 Fafsa Money

Fafsa 2020 21 Is Now Open And Why You Need To Apply Now Student Money Adviser

How To Complete The 2021 2022 Fafsa Application

How To Complete The 2021 2022 Fafsa Application

What Year S Tax Information Do I Use Startwithfafsa Org

Vernon College Fafsa It S Really Not That Difficult

Federal Income Tax Form Simplification Complicates Fafsa Form

7 Things You Need Before Filling Out The 2021 22 Fafsa Form Federal Student Aid

Federal Student Aid On Twitter The 2020 21 Fafsa Launched Today Here S What You Should Know

Filling Out The Fafsa Form Federal Student Aid

How To Complete The 2021 2022 Fafsa Application

Posting Komentar untuk "What Year Taxes Do I Need For Fafsa 2020-21"