What Is The Income Limit For Fafsa 2021

In addition to this families with an AGI of 25000 or less have an EFC of 0 instantly. AND 2 The combined 2019 income of the students.

Do You Earn Too Much To Qualify For College Financial Aid

Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC.

What is the income limit for fafsa 2021. What is Expected Family Contribution EFC. Free Application for Federal Student Aid FAFSA form at fafsagov. The EFC Formula 2021 2022.

The maximum Federal Pell Grant award is 6495 for the 202122 award year July 1 2021 to June 30 2022. The 2021-22 FAFSA income limit is 27000. Financial aid income limits 2019 to 2020 were lower as these limits adjust upward periodically to keep pace with inflation.

However there are a few points you should remember about the process of qualifying for FAFSA. Currently the FAFSA protects dependent student income up to 6660. Before you skip the FAFSA learn more about the basics and the truth about income requirements.

So if the COA is 20000 the student isnt eligible for more than 20000 in need-based aid. For tax filers use the parents adjusted gross income from the tax return to determine if income is 49999 or less. For the 20202021 Award Year an.

This is an increase from the 5711 limit for the 2020 to 2021 school year or the 5576 limit applicable in the 2019 to 2020 academic year. Adjusted Gross Income FAFSA. For non-tax filers use the income.

The Federal Pell Grant is usually awarded to undergraduates who have a high degree of unmet financial need. But the world around this crucial piece of the financial aid. Fill it out as soon as possible to meet school and state deadlines.

Unless the parents earn more than 350000 a year have only one child and that child will enroll at an in-state public college they should still file the FAFSA as there is a good chance they may qualify for federal state or institutional grants. Students whose families have a total income of up to 50000 may be eligible for the need-based funding though most Pell grant money goes to students with a total family income below 20000. When you use the FAFSA to apply for need-based financial aid your Adjusted Gross Income AGI affects the amount of aid you qualify for and the amount that your family is expected to contribute to your education.

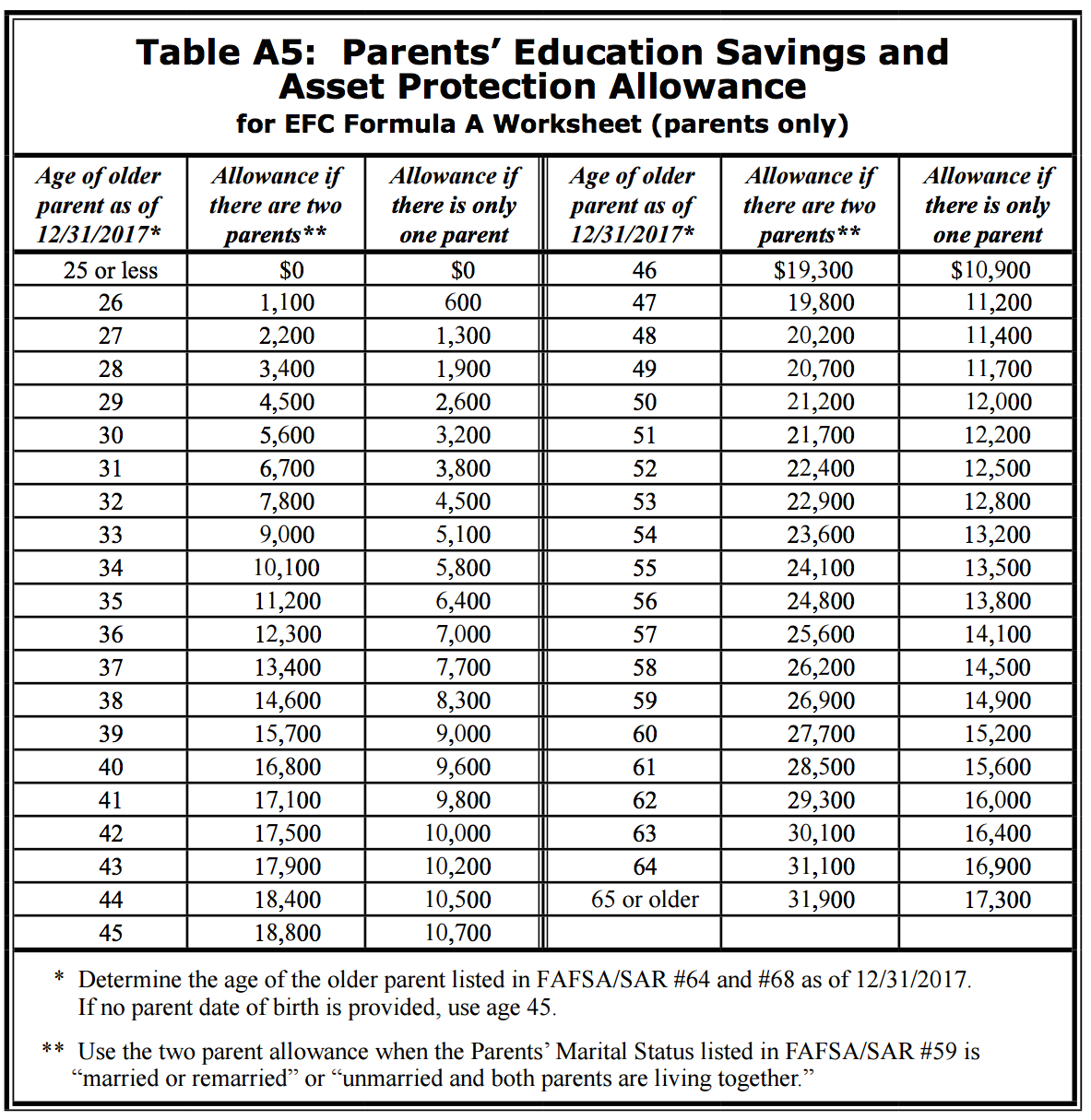

Amounts can change yearly. Every college will calculate financial aid according to their own unique formula. For parents the allowance depends on the number of people in the household and the number of students in college.

Fafsa Income Limit Hey guys quick question. But the truth is most people qualify for some financial aid so its always a good idea to complete the Free Application for Federal Student Aid FAFSA each year your child is in college. Minimum and Maximum Income Limits for FAFSA The Cost of Attendance of the school s listed on FAFSA and the Expected Family Contribution found on the Student Aid Report is what determines the eligibility for financial aid.

For 2019-2020 the income protection allowance for a married couple with two children in college is 25400. That means that you can expect to receive a different. If you plan to attend college from July 1 2020June 30 2021 submit a 202021 FAFSA form.

So there isnt a minimum or maximum income limit to get financial aid from the FSA. The major reason that there is no income limit to apply for financial aid is because financial aid is very complex. There are other requirements to qualify for a simplified or zero EFC.

For this year there is no specified income limit for filling the FAFSA form. Schools and states often use. Is 49999 or less.

The major advantage is a parents assets are not counted when a. The 2021-2022 Free Application for Federal Student Aid called the FAFSA looks similar to last years form with some small tweaks. For non-tax filers use the income shown on the 2018 W-2 forms of both parents plus any other earnings from work not included on the W-2s to determine if income is 49999 or less.

For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. Usually the decision is made by comparing the Expected Family Contribution EFC to the cost of school attendance. If so make sure you include these in your FAFSA application.

My buddy filled out his FAFSA and it was determined he wouldnt get the pell grant for the 2021-2022 academic school year. It is common for people to think they make too much money to qualify for financial aid. Here is an example of how EFC is calculated.

The income protection allowance changes each year. For tax filers use the parents adjusted gross income from the tax return to determine if income is 49999 or less. 1 for the next school year.

The FAFSA form is available every Oct. The amount you get. Find out how your AGI factors into your Expected Family Contribution EFC and.

Fafsa Basics Parent Assets The College Financial Lady

Do You Earn Too Much To Qualify For College Financial Aid

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

Do My Savings Affect Financial Aid Eligibility Money

What Is The Income Limit For Fafsa 2021

What Is The Income Limit For Fafsa 2021

Expected Family Contribution Efc Fafsa Vs Css Calculations

Fafsa For 2021 Income Limits Aid Types And More Student Loan Hero

Fafsa Eligibility Guide To Qualify And Apply For Federal Student Aid

How Much Is Too Much Income To Qualify For Financial Aid

Eligibility Requirements Educational Opportunity Fund Stockton University

Posting Komentar untuk "What Is The Income Limit For Fafsa 2021"