What Is The Max Income For Fafsa

To be eligible for receiving financial aid your COA must be higher than ECT. Between the employment expense allowance and adjustments for taxes that income would add virtually nothing to EFC.

What Is The Maximum Income To Qualify For Financial Aid

So there isnt a minimum or maximum income limit to get financial aid from the FSA.

What is the max income for fafsa. Adjusted Gross Income FAFSA. Completing and submitting a FAFSA is the first and most important step in accessing those funds. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC.

The key to receiving a. When you use the FAFSA to apply for need-based financial aid your Adjusted Gross Income AGI affects the amount of aid you qualify for and the amount that your family is expected to contribute to your education. Most Pell Grant recipients make less than 50000 per year.

Every college student is encouraged to apply for federal aid through the FAFSA and your parents income level will have no bearing on some available aid. Because financial need is determined by the cost of school minus income there is no set maximum income that can prevent you from qualifying for financial aid. The maximum Pell Grant is 6095 for the 201819 award year July 1 2018 to June 30 2019.

The Free Application for Federal Student Aid FAFSA provides students with access to thousands of grants and loans based on their financial need. And its limited to 35 of the lower income or a maximum of 4000. The federal government uses the FAFSA to provide more than 150 billion in scholarships grants student loans and work-study funds each year.

Every college will calculate financial aid according to their own unique formula. There is no specific income limit. 4 реда How much income is too much for fafsa.

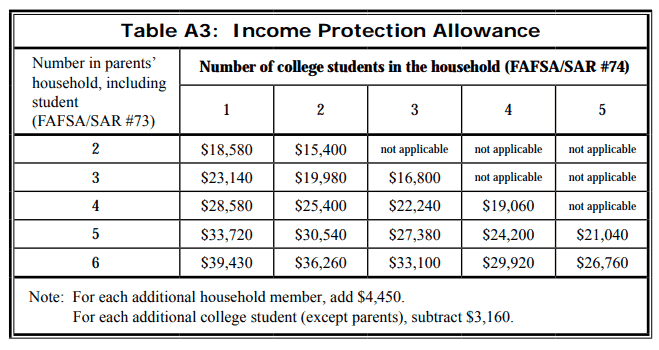

Household income does however restrict certain financial aid types such as Pell Grants and other need-based awards. The FAFSA application uses a complex need analysis formula to evaluate income number of people in the household and in college age of the eldest parent investments cash savings checking and even the state of legal residence. For example Harvard says.

For private schools tuition and fees average 32410. There is no stated maximum income to qualify for financial aid. For students who havent earned lucrative scholarships need-based financial aid can play a vital role.

For the 201920 academic year the maximum amount you can receive from a Pell Grant is 6195. For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. For any amount above your income protection allowance.

If you fall below specific income levels you can qualify for the maximum each year. Find out how your AGI factors into your Expected Family Contribution EFC and. For the 2019-2020 award year you can receive up to 6195.

Families with incomes between 65000 and 150000 will contribute from 0-10 of their income and those with incomes above 150000 will be asked to pay proportionately more than 10 based on their individual circumstances. The amount you receive depends on the cost of your school as well as what the maximum federal amount allotted is. This ultimately reduces the ECT thus the likelihood of receiving financial aid becomes slim.

11500 of income will get the maximum allowance. If youre a dependent student and your familys annual income if less than 26000 your EFC will be considered zero. Common Income Counted in the FAFSA Formula Income from work except work-study income Proceeds from asset sales dividends and capital gains Retirement fund withdrawals Untaxed income such as elective retirement fund contributions and money spent by non-parents on the students behalf.

But there are no simple FAFSA income limits or income cutoffs on financial aid eligibility in part due to the complexity of financial aid formulas. However a higher household income means a high Expected Family Contribution. The major reason that there is no income limit to apply for financial aid is because financial aid is very complex.

The cutoff also depends on the institution and the range can be broad. This is a maximum of 4000 but in a two-parent household it can only be claimed if both parents work. But there is a cap on the earning technically the lowest threshold of income which means your Expected Family Contribution EFC will stand at 0.

Unless the parents earn more than 350000 a year have only one child and that child will enroll at an in-state public college they should still file the FAFSA as there is a good chance they may qualify for federal state or institutional grants. If you fall below specific income levels you can qualify for the maximum each year. As mentioned above there is no income limit for FAFSA this year.

That means that you can expect to receive a different financial aid. But even if your family does have greater resources you should still submit the FAFSA.

5 Things To Do After Filing Your Fafsa Form Financial Avenue

Eligibility Requirements Educational Opportunity Fund Stockton University

Fafsa Basics Parent Assets The College Financial Lady

How Much Is Too Much Income To Qualify For Financial Aid

Do You Earn Too Much To Qualify For College Financial Aid

Do You Earn Too Much To Qualify For College Financial Aid

What Is The Maximum Income To Qualify For Financial Aid

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

Do My Savings Affect Financial Aid Eligibility Money

Posting Komentar untuk "What Is The Max Income For Fafsa"