What Year Income Is Used For Fafsa

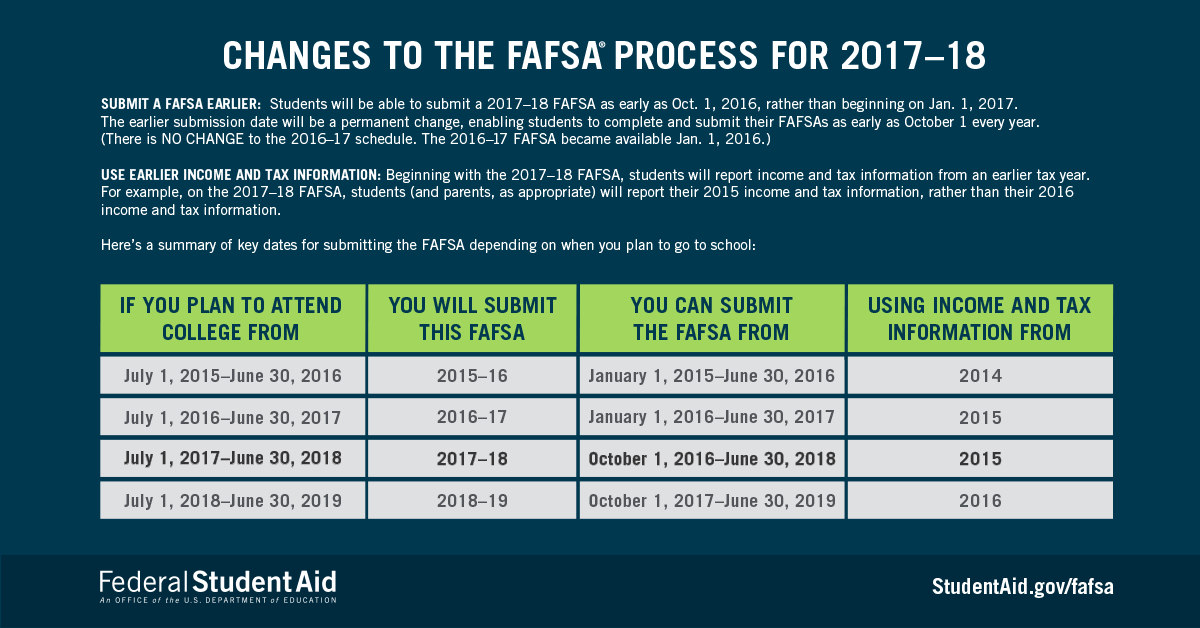

For purposes of completing the FAFSA income is reported for the year that is two years prior to the school year for which financial aid is being requested. Currently the FAFSA asks students to report their familys income from the prior calendar year.

Understanding Fafsa How To Qualify For More College Financial Aid Greenbush Financial Group

It is the yearly income upon which the financial aid award is based.

What year income is used for fafsa. The FAFSA will want information on available cash balances in savings and checking accounts and any investment portfolios. The FAFSA switched from prior-year income to prior-prior-year income starting with the 2017-2018 FAFSA for several reasons. Starting in Oct.

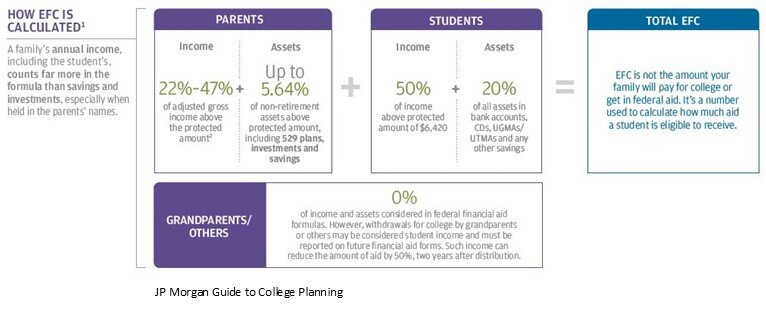

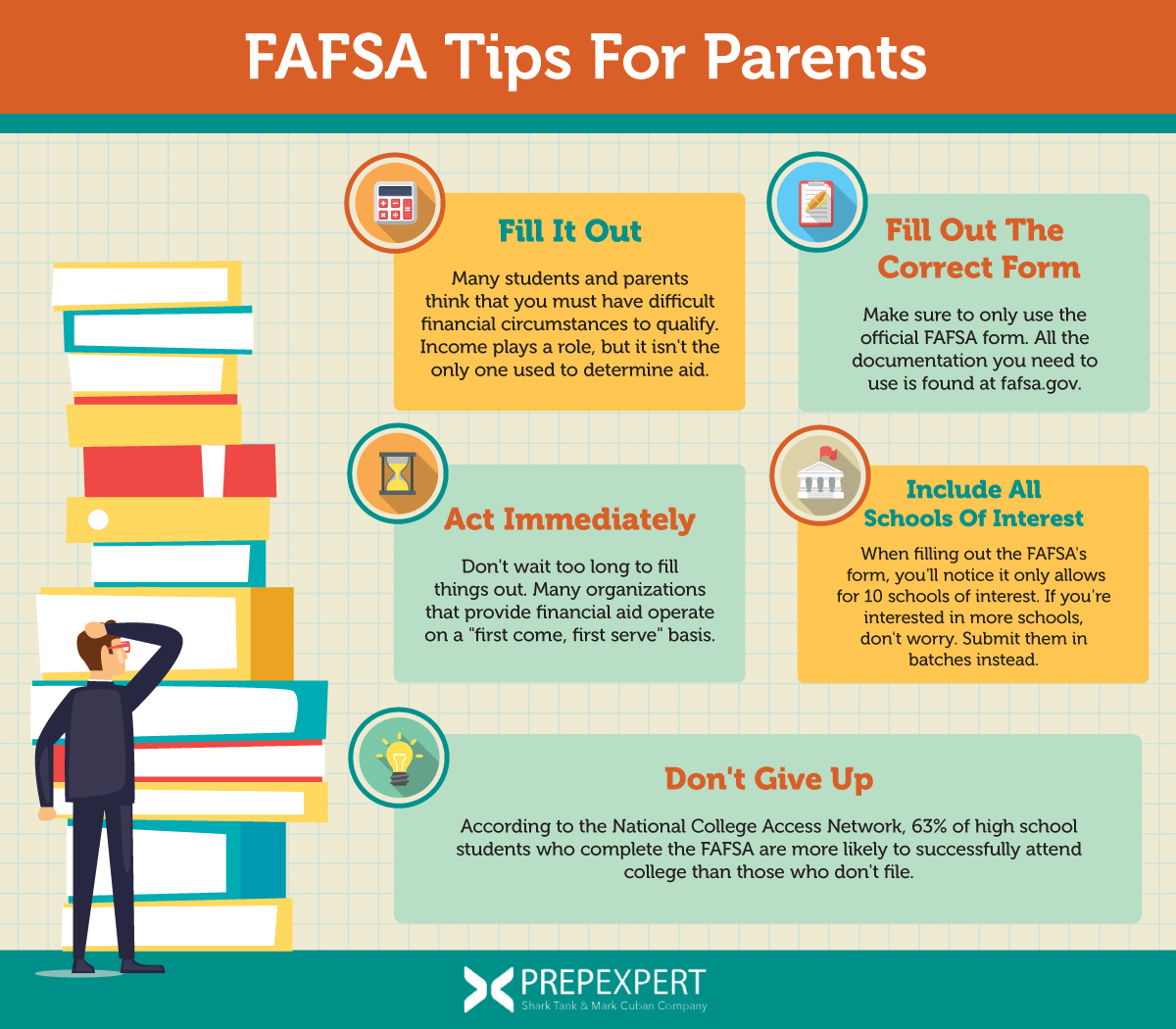

This puts both the students and parents in an advantageous position as they will be able to complete FAFSA as early as possible. The FAFSA uses a standardized form to ensure that every applicant has the same criteria for calculating income and assessing need-based aid. Essentially your EFC helps your schools financial aid office assess your family ability to contribute to your education for the upcoming academic year.

The income protection allowance changes each year. 2016 and going forward the tax return youll use to fill out the FAFSA is from two years prior to the year your student will start college. For example if you are applying for financial aid for the 2019-20 school year then you are obligated to provide your 2017 tax information The FAFSA considers student income in addition to parent income for dependent students or spousal income for.

For parents the allowance depends on the number of people in the household and the number of students in college. You cannot update your 2020-21 FAFSA form with your 2019 tax information after you file your 2019 tax return. And its limited to 35 of the lower income or a maximum of 4000.

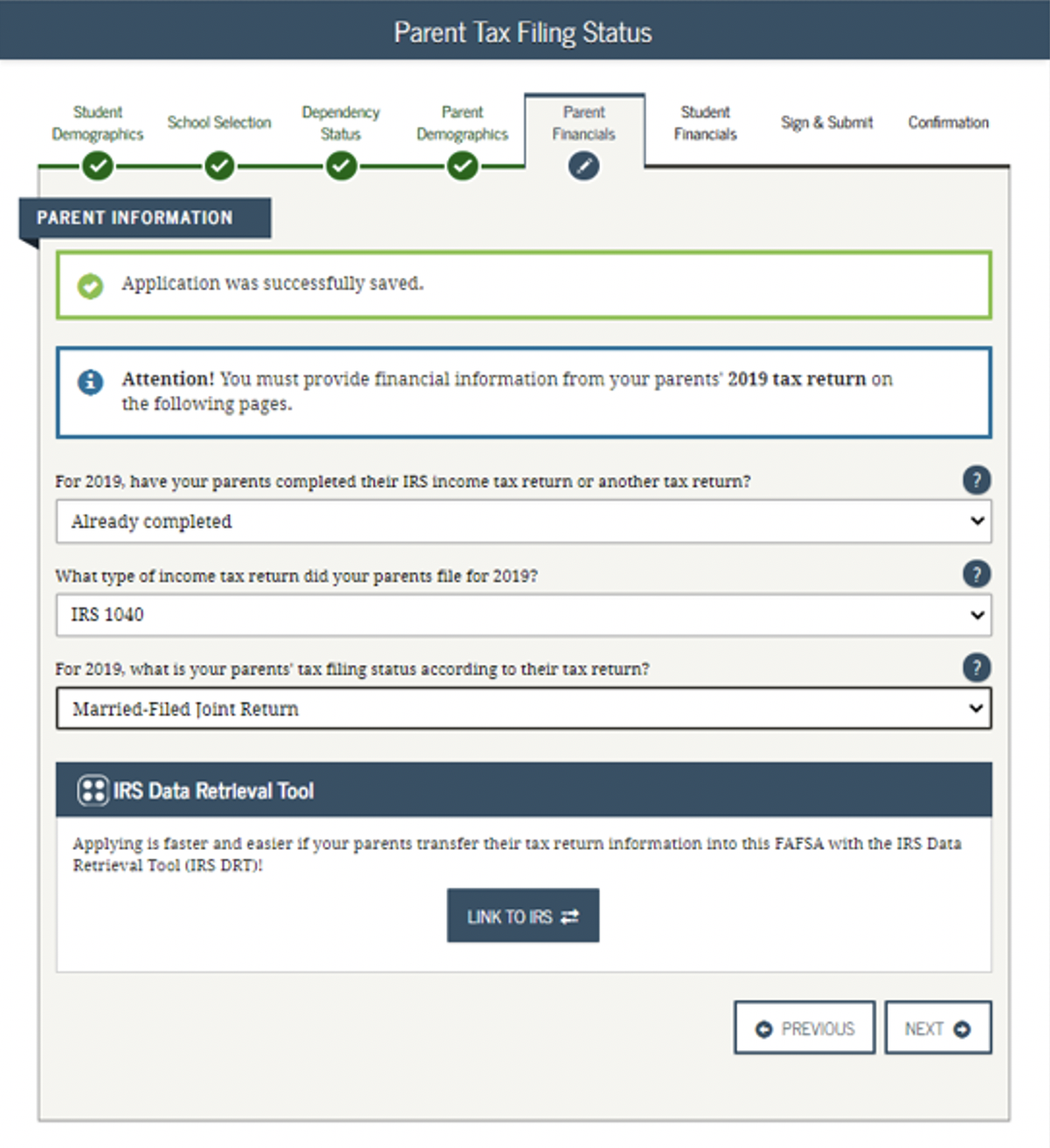

The 2020-21 FAFSA form requires only 2018 tax information. Even if you complete FAFSA form after you file your 2020 tax return you will need to use the 2019 tax return you filed in 2020. For 2019-2020 the income protection allowance for a married couple with two children in college is 25400.

The EFC is the number generated from. However this is now. Parents may find that different strategies are.

Why do the government and colleges use last years income to determine financial aid for the current year. The FAFSA questions about untaxed income such as child support interest income and veterans non-education benefits may or may not apply to you. What Can FAFSA Money Be Used For.

You will also need to report untaxed income such as child support received interest income and any non-education veterans benefits. Their first base year would thus be 2015. This is a maximum of 4000 but in a two-parent household it can only be claimed if both parents work.

Are you trying to figure out what income information to provide for your parents where they are divorced and you are living with one of them. Even though college financial aid may seem like free money you cant spend it on anything you want. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC.

These necessary purchases may be defined under your schools itemized cost of attendance. Our financial situation has changed my husband was laid off last year but our FAFSA looks okay because of his severance pay. Use of the prior-prior year allows the FAFSA to be based on federal income tax returns that have already been filed as.

Since theres now an almost 2-year lag between income and aid anything after your childs. For example for students entering college in the fall of 2020 families will fill out the FAFSA in October 2019 and use their tax return from 2018. You can only spend your federal financial aid money on purchases that are necessary for you to continue your studies.

Currently the FAFSA protects dependent student income up to 6660. Find current financial aid information here. Between the employment expense allowance and adjustments for taxes that income would add virtually nothing to EFC.

For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. The parent of a high school senior who is beginning college in 2016 would report their prior years income. Whose Income Is Used on FAFSA When Parents Are Divorced Are you filling out the FAFSA to get financial aid for college.

We need financial aid help in order IN_FEED_PLACEMENT to help our daughter. This means on FAFSA 202122 the 2019 income will be reported not 2020. A students aid package can be reduced by up to 50 of the students income during the base year.

11500 of income will get the maximum allowance. This article is out of date. All real estate holdings other than the house you live in must be listed as well as any business or farm assets.

The annual income threshold to receive an expected family contribution or EFC of zero increased from 26000 to 27000. With the income limit of 160000 married filing joint or 80000 single some families might not be eligible every year. Records of Your Untaxed Income.

How To Fill Out A Fafsa Without A Tax Return H R Block

Free Application For Federal Student Aid Fafsa George T Baker Aviation Tc

11 Common Fafsa Mistakes U S Department Of Education

How To Complete The 2021 2022 Fafsa Application

Filling Out The Fafsa Form Federal Student Aid

11 Common Fafsa Mistakes U S Department Of Education

How To Complete The 2021 2022 Fafsa Application

How To Complete The 2021 2022 Fafsa Application

How To Complete The 2021 2022 Fafsa Application

5 Things To Do After Filing Your Fafsa Form U S Department Of Education

Fafsa Tips For Parents Prep Expert

Posting Komentar untuk "What Year Income Is Used For Fafsa"