What Income Is Needed For Financial Aid

The average pay range for a Financial Aid varies greatly by as much as 17000 which suggests there may be many opportunities for advancement and increased pay based on skill level location and years of. Dividends and capital gains earned in taxable brokerage accounts count as income.

Show Me The Money Making Sense Of Financial Aid Ppt Download

It is common for people to think they make too much money to qualify for financial aid.

What income is needed for financial aid. Mutual funds and other brokerage assets held by parents are counted on the FAFSA. For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. Citizen Your federal income tax returns W-2s and other records of money earned.

What is the income limit to qualify for financial aid. Your parents income if youre under 25 and live with them or depend on them financially the combined income of one of your parents. The Free Application for Federal Student Aid FAFSA is based on income and tax information from the prior-prior year federal income tax return current asset information and current demographic information.

The Hope Scholarship tax credit is available to families with income up to 90000 single filers and 180000 married filing joint. There is no specific income limit. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC.

The FAFSA application uses a complex need analysis formula to evaluate income number of people in the household and in college age of the eldest parent investments cash savings checking and. 1 at the official government site fafsagov. Lets break down the forms that you will need for both the FAFSA and the CSS profile before looking at the additional documents needed for each one specifically.

Gathering certain documents in advance will make filing the FAFSA easier. For any amount above your income protection allowance roughly every 10000 in extra income lowers your financial aid qualification by another 3000. Itll be easier to complete the FAFSA form if you gather.

That means that you can expect to receive a different financial aid. Your household income includes any of the following that apply. A portion of student income is sheltered from the financial aid formula but as much as half of income.

Income-tested means that a person must have an income at or below a certain level to be eligible for the aid or to determine customer contribution to aid. You should fill it out as soon as possible on or after Oct. Every college will calculate financial aid according to their own unique formula.

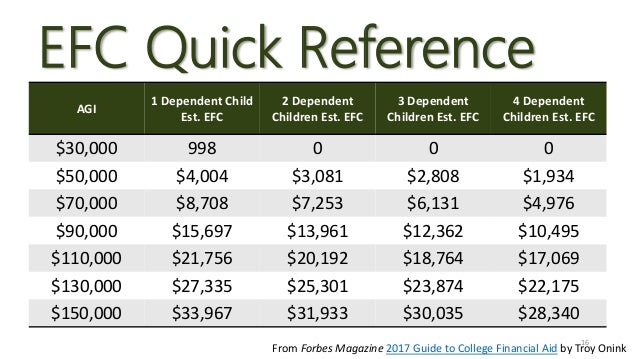

The 202021 FAFSA form is available beginning Oct. Distributions from a mutual fund. Once the income is above 100K roughly 15th to 14th of income will be counted towards your EFC.

If you need financial aid to help pay for college you must complete the Free Application for Federal Student Aid FAFSA form. As told above the amount of federal grant depends on family income and a few other factors. Keep a copy of these documents in case you need them later.

Financial Aid Income Guidelines Workforce Solutions uses multiple sets of income guidelines when determining eligibility for our income-tested financial aid funds. But there are no simple FAFSA income limits or income cutoffs on financial aid eligibility in part due to the complexity of financial aid formulas. To qualify for the simplified needs test the income reported by the student and the students spouse if the student is independent or the students parents if the student is dependent must be less than 50000.

A students eligibility for need-based financial aid is determined by a simple need analysis formula that subtracts the students expected family contribution EFC from a colleges total cost of. But the truth is most people qualify for some financial aid so its always a good idea to complete the Free Application for Federal Student Aid FAFSA each year your child is in college. Unless the parents earn more than 350000 a year have only one child and that child will enroll at an in-state public college they should still file the FAFSA as there is a good chance they may qualify for federal state or institutional grants.

If parents have a single child and their income is below 350000 a year there is a good chance that their kids will get qualified for this given they have filled out the FAFSA application. The simplified needs test causes assets to be disregarded on the FAFSA. What is the Maximum Income to Qualify for Financial Aid.

According to NAIS or the National Association of Independent Schools nearly 20 of students at private schools nationwide are awarded some financial aid and the average grant of need-based aid was 9232 for day schools and 17295 for boarding schools in 2005. Before you skip the FAFSA learn more about the basics and the truth about income requirements. The major reason that there is no income limit to apply for financial aid is because financial aid is very complex.

Note that student employment can have a big impact on aid eligibility especially for independent students. Your Social Security Number or Your Alien Registration Number if you are not a US.

How To Get Financial Aid Making Multiple Six Figures A Year

Do My Savings Affect Financial Aid Eligibility Money

How Much Is Too Much Income To Qualify For Financial Aid

Financial Aid Eligibility Federal Student Aid

Average Financial Aid Award By Income

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

College Financial Aid Basics 2019 2020

Do I Make Too Much To Qualify For Financial Aid Greenbush Financial Group

How Much Is Too Much Income To Qualify For Financial Aid

Fafsa For 2021 Income Limits Aid Types And More Student Loan Hero

Middle Class Often Left Out Of College Financial Aid The Bruin Voice

Posting Komentar untuk "What Income Is Needed For Financial Aid"