What Tax Year Does Fafsa Use For Fall 2020

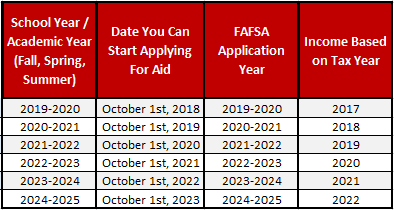

For example starting on October 1 2020 more than 90 of applicants will be filing the FAFSA for the 2021-2022 academic. One of the keys to successful 2021-22 FAFSA completion is timely completion of the 2019 federal tax return for families that were required to file.

What Tax Year Does Fafsa Use For 2020

Even if you the parent of the student havent filed a tax return by then due to an extension you will have 15 more days to file your 2019 tax return.

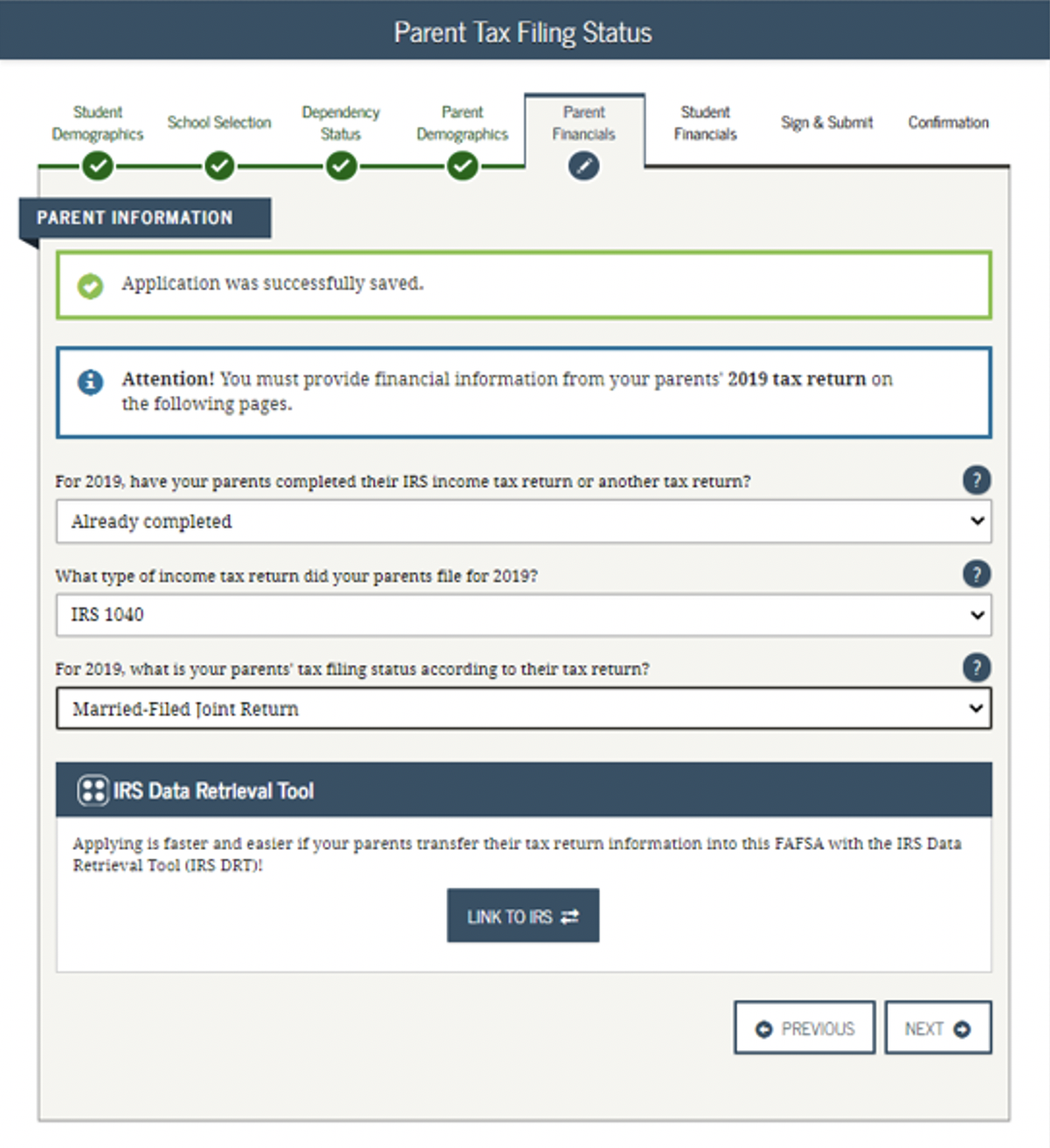

What tax year does fafsa use for fall 2020. As for what years tax return will be provided on FAFSA for the 202122 academic year the parents 2019 tax return will be used. The Simplified Needs Test is the formula that calculates your Expected Family Contribution EFC and increases eligibility for financial aid. This change was intended to simplify the FAFSA process.

Or apply free online at. June 30 2021 is the federal deadline. As a result applicants use tax information that is likely already filed.

2019 - 2020 Financial Aid. While the FAFSA opened on Oct. You should fill it out as soon as possible on or after Oct.

1 in 2016 the rules about which years tax information to use were also updated. FAFSA July 1 2021 June 30 2022. 1 at the official government site fafsagov.

This means on FAFSA 202122 the 2019 income will. The 2019 - 2020 FAFSA should be completed with tax year 2017 information the prior-prior year. Use Your Tax Return Now go to page 3 of the FAFSA form and begin filling it out.

Itll be easier to complete the FAFSA form if you gather what you need ahead of time. Chatter isnt enabled or the user doesnt have Chatter access. The 2021-2022 FAFSA is based on 2019 tax year information.

For example a family with a student beginning college in fall of 2020 might reduce pre-tax retirement contributions this year to increase taxes which are deducted from income on the FAFSA and therefore reduce EFC and then maximize contributions beginning in 2021 to reduce AGI for AOTC claiming purposes. 5 to 15 years. If you filled out the 201920 FAFSA you still need to complete the 202021 FAFSA if you want aid for the.

Refer to the notes on pages 9 and 10 as instructed. The Tax Documents You Need. This means no waiting on your next W2 to complete or update the FAFSA.

The tool automatically enters your tax information exactly as it was submitted for that tax year reducing the. Use Tax Year Data. The FAFSA requires applicants to use tax information from an earlier tax year not the year of application.

Most students who file a FAFSA during the overlap period are filing the FAFSA for the upcoming academic year. You can complete this beginning October 1st 2020 for the Fall 2021 Spring 2022 and Summer 2022 semesters. You will be able to use your anticipated lower 2019 income when you complete the 2021-2022 FAFSA.

You can simplify the process by using the IRS Data Retrieval Tool. 1 for the 2020-2021 academic year youve got some time to complete the forms. For the 2020-2021 FAFSA you will have to use 2018 income.

When the FAFSAs release date was moved to Oct. Since applications for the FAFSA 202122 Award Year begins on October 1 2020 parents should have filed their taxes by then. If youre applying for financial aid for the 20212022 school year you should file a 20212022 FAFSA form which is based on 2019 income tax returns.

Its important to emphasize that filling out a FAFSA is good for just one school year. 113 to 1123. 3 реда Academic School Year.

If you are submitting the 20192020 FAFSA you will be able to use the IRS Data Retrieval Tool to import tax information electronically from tax forms beginning October 1 2018. September 21 2020. For the FAFSA for the 2019-2020 school year youll use the information on your 2017 tax return not your 2018 return.

Use this form to apply free for federal and state student grants work-study and loans. The 202021 FAFSA form is available beginning Oct. Heres what youll need to fill it out.

High school seniors planning to enroll in college in fall 2019 will complete the 20192020 FAFSA and report income from tax year 2017. The Free Application for Federal Student Aid FAFSA bases income and tax information on a specific years federal income tax returns the prior-prior year. If you need financial aid to help pay for college you must complete the Free Application for Federal Student Aid FAFSA form.

You cannot substitute income and tax information from a more recent year even if the information is available. In past years you could submit the 1040 1040 A and 1040 EZ tax forms the 1040A and 1040EZ are what would contribute to the eligibility for the Simplified Needs Test.

When To Do Fafsa For Fall 2020

Verification Financial Aid Home Ttu

What Year S Tax Information Do I Use Startwithfafsa Org

Financial Aid Faq Admissions University Of Nebraska Omaha

How To Complete The 2021 2022 Fafsa Application

Start Here Steps To Apply Faqs Lord Fairfax Community College

Early Fafsa Houston Community College Hcc

How To Complete The 2021 2022 Fafsa Application

Vernon College Fafsa It S Really Not That Difficult

When Is The Fafsa Deadline 2021 2022 Edvisors

How To Complete The 2021 2022 Fafsa Application

Posting Komentar untuk "What Tax Year Does Fafsa Use For Fall 2020"