What Income Tax To Use For Fafsa

Income tax amount is the total of IRS Form 1040line 13 minus Schedule 2line 46. FAFSA Free Application for Federal Student Aid is asking for 2019 tax and income information because it evaluates applications based on previous income.

What Was Your Income Tax For 2018 Federal Student Aid

The FAFSA questions about untaxed income such as child support interest income and veterans non-education benefits may or may not apply to you.

What income tax to use for fafsa. For questions 8492 if the answer is zero or the question does not apply enter 0. What Does Income Tax Mean for FAFSA. Return To FAFSA Guide.

Report whole dollar amounts with no cents. What tax year information should I use to complete my FAFSA. Your 2019 Tax Records.

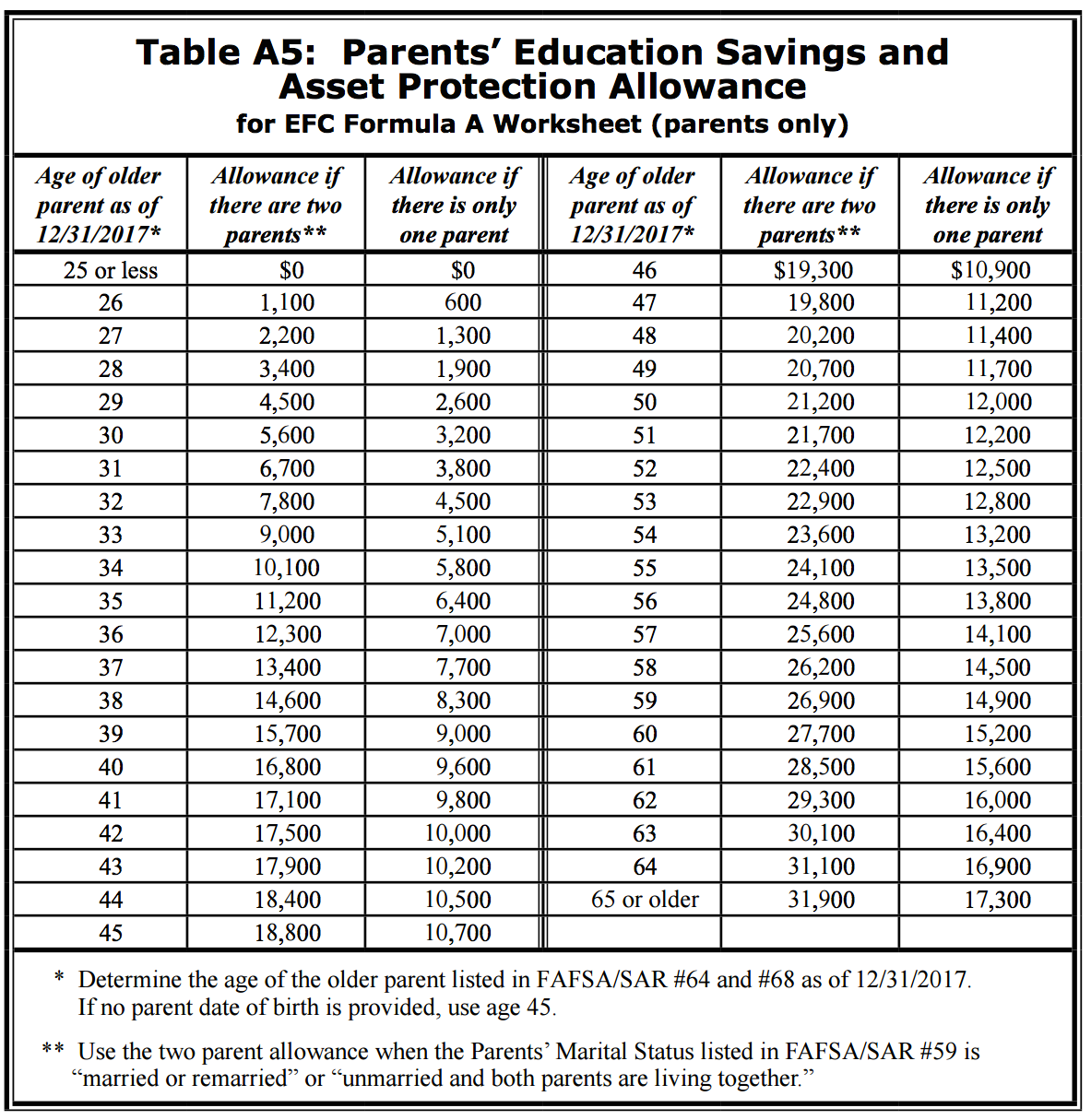

If negative enter a zero here. For Fafsa income tax is not all of your salary that is the income that goes into your home. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC.

While this might not match the tax or income status that is on your tax return it doesnt matter. You still need to report your marital status as of the day you filled out the FAFSA. Records of Your Untaxed Income.

You will also need to report untaxed income such as child support received interest income and any non-education veterans benefits. If you already have filed your 2019 taxes by the time the FAFSA form is available you may be eligible to import your tax information into the FAFSA form right away using the IRS Data Retrieval Tool. Using the DRT reduces the chances of being asked to provide additional IRS.

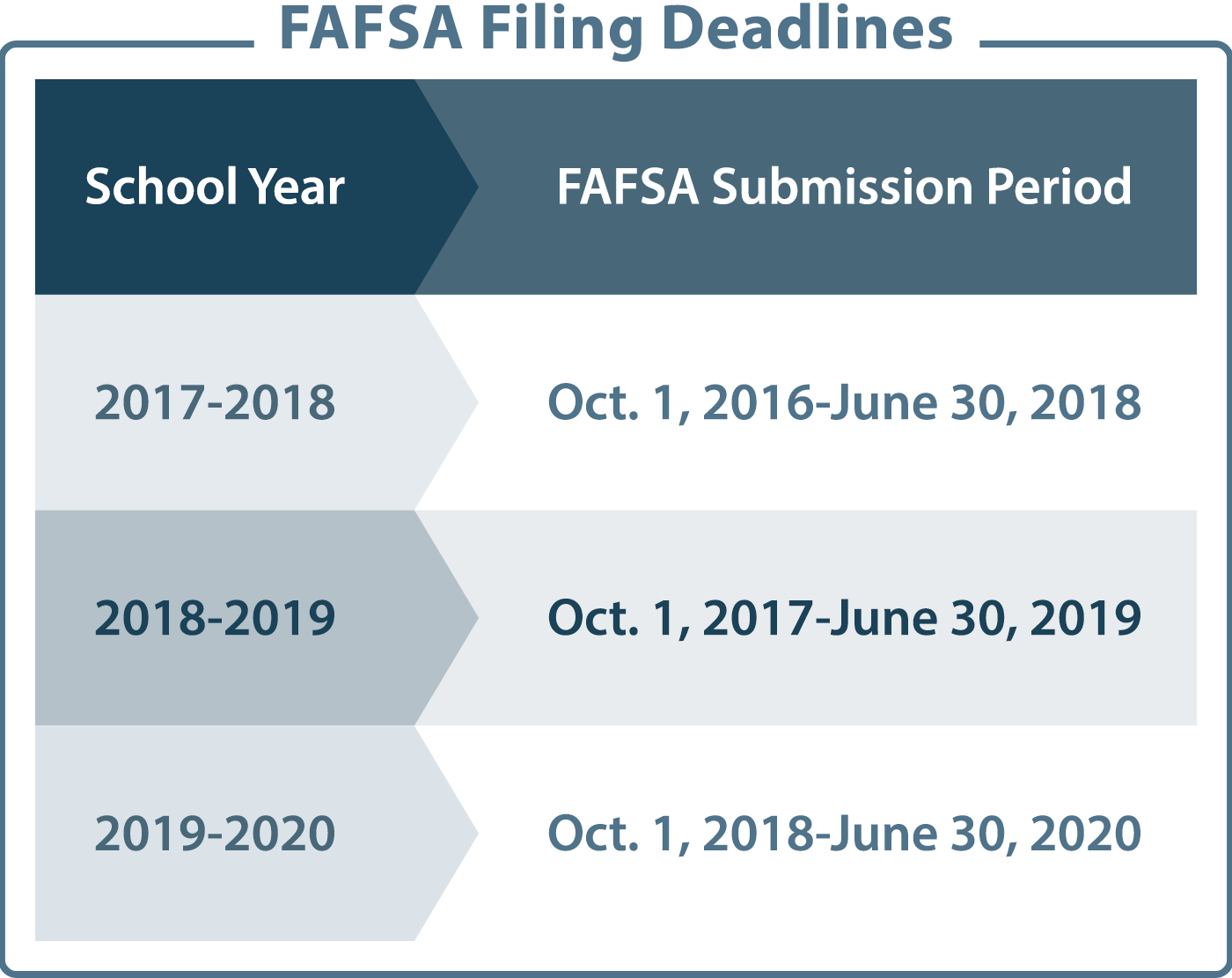

The FAFSA switched from prior-year income to prior-prior-year income starting with the 2017-2018 FAFSA for several reasons. Using the DRT when completing the FAFSA saves you time is secure your data is encrypted and is the most accurate. Are you trying to figure out what income information to provide for your parents where they are divorced and you are living with one of them.

__ __ __ __ __ __ __. That can get confusing but fortunately here is the answer. Finally heres some information about getting alternative documentation for IDR applications.

Enter your parents income tax for 2019. For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. This means on FAFSA 202122 the 2019 income.

The IRS Information Recovery instrument can be utilized to drag exact data straightforwardly from the IRS from charges that have as of now been filed. Information on income as well as assets is used to. As for what years tax return will be provided on FAFSA for the 202122 academic year the parents 2019 tax return will be used.

The 2020-21 FAFSA form requires only 2018 tax information. In addition to income the FAFSA. You cannot update your 2020-21 FAFSA form with your 2019 tax information after you file your 2019 tax return.

On the 2020-21 FAFSA form youll report 2018 tax. All real estate holdings other than the house you live in must be listed as well as any business or farm assets. Determining which line of Form 1040 lists your total income tax for the FAFSA may be confusing.

Even if you the parent of the student havent filed a tax return by then due to an extension you will have 15 more days to file your 2019 tax return. Use the IRS Data Retrieval Tool DRT to transfer tax data directly from the IRS to your FAFSA for everyone listed on the FAFSA. Taxpayers who filed an amended tax return Form 1040-X should use the adjusted gross income and earned income listed on their revised tax return.

Income Tax Mean On Fafsa. IRS Data Retrieval plan applicants must submit alternative documentation of income. Since applications for the FAFSA 202122 Award Year begins on October 1 2020 parents should have filed their taxes by then.

There are some criteria of income tax for fafsa and as follows. The FAFSA requires that you provide the marital status as of today so that they know your status going into the new school year. For families with annual incomes below 26000 who received one or more federal welfare benefits and filed a 1040A or 1040EZ tax form before 2018 when these forms were eliminated zero income is counted on the FAFSA.

You only include the income of your custodial parent which includes any alimony andor child support paid by the noncustodial parent. In each of sections concerning the students and the parents financial information the FAFSA asks. The FAFSA will want information on available cash balances in savings and checking accounts and any investment portfolios.

Use of the prior-prior year allows the FAFSA to be based on federal income tax returns that have already been filed as opposed to estimating income and tax information. Because of changes to tax forms from the new tax plan some filers will be unable to use the. Detail The 2019 - 2020 FAFSA should be completed with tax year 2017 information the prior-prior year.

On the 202122 FAFSA form you and your parents if you are a dependent student will report your 2019 income information.

How To Complete The 2021 2022 Fafsa Application

How To Complete The 2021 2022 Fafsa Application

12 Common Fafsa Mistakes U S Department Of Education

How To Complete The 2021 2022 Fafsa Application

Federal Income Tax Form Simplification Complicates Fafsa Form

Money Under 30 S Guide To Filling Out The Fafsa Money Under 30

True Or False You Can Fill Out Your Fafsa Before Filing Taxes U S Department Of Education

What Was Your Parents Total Income Tax For 2019 Federal Student Aid

11 Common Fafsa Mistakes U S Department Of Education

What Was Your Parents Total Income Tax For 2019 Federal Student Aid

Posting Komentar untuk "What Income Tax To Use For Fafsa"