What Assets Affect Financial Aid For College

Allison Schmidt Financial Advisor CPA CFP Its almost the start of another school year and a question I get quite often in regards to college savings plans is how will this account affect my kids chance of getting financial aid. How Assets Impact Financial Aid Oct 24 2016 This is an especially relevant question because parents are now filing for financial aid for the 20172018 school year.

Do You Earn Too Much To Qualify For College Financial Aid

Money in a 529 college savings plan that is owned by the student or the parent is reported as a parent asset.

What assets affect financial aid for college. If you keep your emergency fund in CDs youll list it under reportable assets when you apply for financial aid along with other assets like stocks bonds and brokerage accounts. How Different Assets Affect College Financial Aid By. As of June 1 2021 the one-month LIBOR rate is 009.

Strategies and tactics to minimize parent assets abound but for most families these result more in nibbling around the edges than actually making. Dividends and capital gains earned in taxable brokerage. Compared to the parents assets financial assets belonging to children have a far greater impact on a familys eligibility for financial aid.

Trust funds can significantly reduce a students eligibility for need-based financial aid. Assets in the childs name including a savings account trust fund or brokerage account will count more heavily against the financial aid award than assets in. Parent assets seem to be the area that most families and planners focus on despite the fact that they typically have the smallest impact on the formula of each of the components.

Mutual funds and other brokerage assets held by parents are counted on the FAFSA. Financial aid application forms do not consider debt as offsetting assets except to the extent that the debt is secured by an asset such as margin debt in a brokerage account. The FAFSA assesses parental assets at up to 564 percent while the CSS Profile assesses them at up to 5 percent.

Parent assets are assessed on a bracketed scale with a top bracket of 564. Assets owned by a younger sibling are not reported on your FAFSA but may be reported on the CSSFinancial Aid PROFILE form. This leads to a high impact on eligibility for need-based financial aid.

Put another way for every 10000 that parents have in college accounts or other. Student and Parent Assets Are Counted Differently Families must report assets owned by the parents and the child in their aid applications. Variable interest rates will fluctuate over the term of the loan with changes in the LIBOR rate and will vary based on applicable terms level of degree and presence of a co-signer.

Student assets reduce aid eligibility by 20 of the asset value. If the trust fund document restricted the beneficiarys access to the principal the trust fund will affect aid eligibility every year. The maximum variable rate is the greater of 2100 or Prime Rate plus 900.

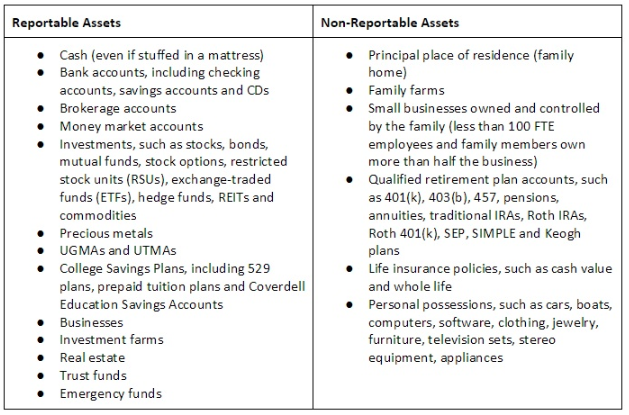

Some assets however are considered non-reportable for FAFSA purposes. As you can see allocating assets so that theyre in the parents names rather than the students will reduce the EFC increasing financial aid possibilities. However money in a 529 college savings plan prepaid tuition plan or Coverdell education savings account is reported as a.

Assets that arent in retirement accounts --- balances in checking savings CDs brokerage accounts money market investment real estate stocks bonds mutual funds ETFs commodities and 529. 9 rows Student Assets Colleges expect that up to 20 of the assets owned by a. Almost all trust funds are counted in the financial aid process often as an asset of the child.

Trust funds must be reported as the beneficiarys asset on the Free Application for Federal Student Aid FAFSA even if access to the trust is restricted.

How 5 Common College Savings Strategies Affect Financial Aid

How Your Income And Assets Impact How Much Financial Aid You Get

Hife Scholars Newsletter January 2016 Edition

How To Shelter Assets On The Fafsa

How Do Grandparent Owned 529 College Savings Plans Affect Financial Aid Eligibility Fastweb

Fafsa Basics Parent Assets The College Financial Lady

Fafsa Basics Parent Assets The College Financial Lady

How These 6 Assets Might Affect Student Financial Aid Eligibility

Your Student S Income Won T Hurt Their Financial Aid Highland Financial Advisors

How Different Assets Affect College Financial Aid

How Do Grandparent Owned 529 College Savings Plans Affect Financial Aid Eligibility Fastweb

Posting Komentar untuk "What Assets Affect Financial Aid For College"