What Tax Year For Fafsa 2020-21

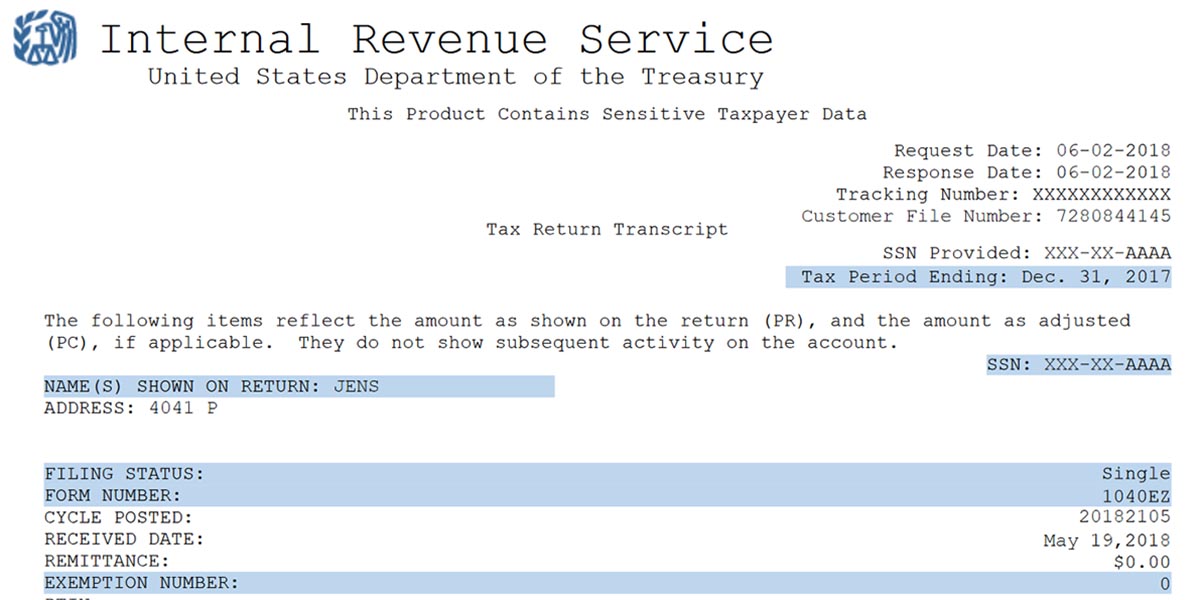

2018 Tax Return Line Items for 2020-21 Verification. That means that the 202021 FAFSA form will disappear from fafsagov on June 30 2021 because thats the end of the 202021 school year.

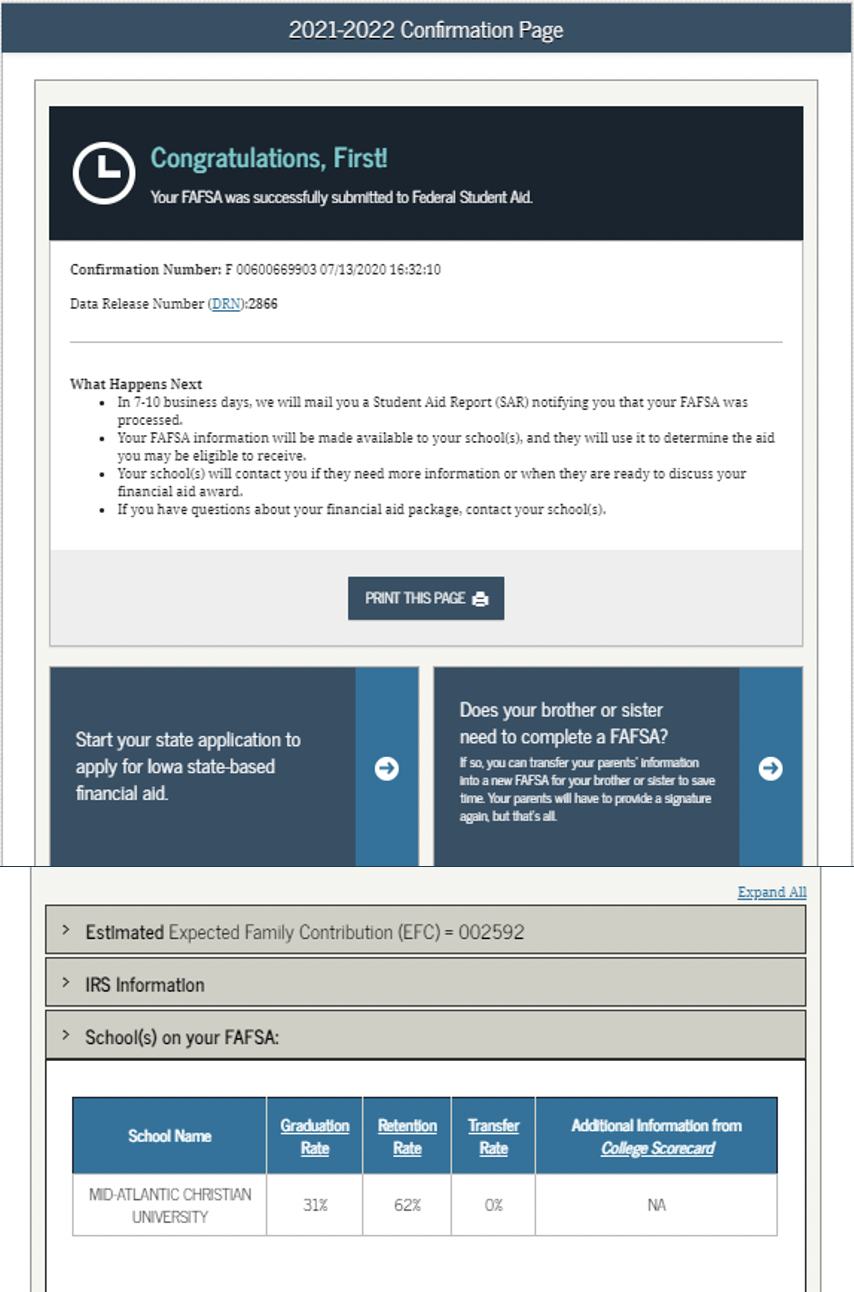

How To Complete The 2021 2022 Fafsa Application

1 2019 and it is open until June 30 2021.

What tax year for fafsa 2020-21. In place of the transcript the Financial Aid Office can. You will submit your tax information from two years prior rather than your taxes for the most recent filing year so for the 202021 FAFSA you will provide information from the 2018 tax year. Tax return line items listed in the FAFSA instructions which should be reviewed for potential conflicting information.

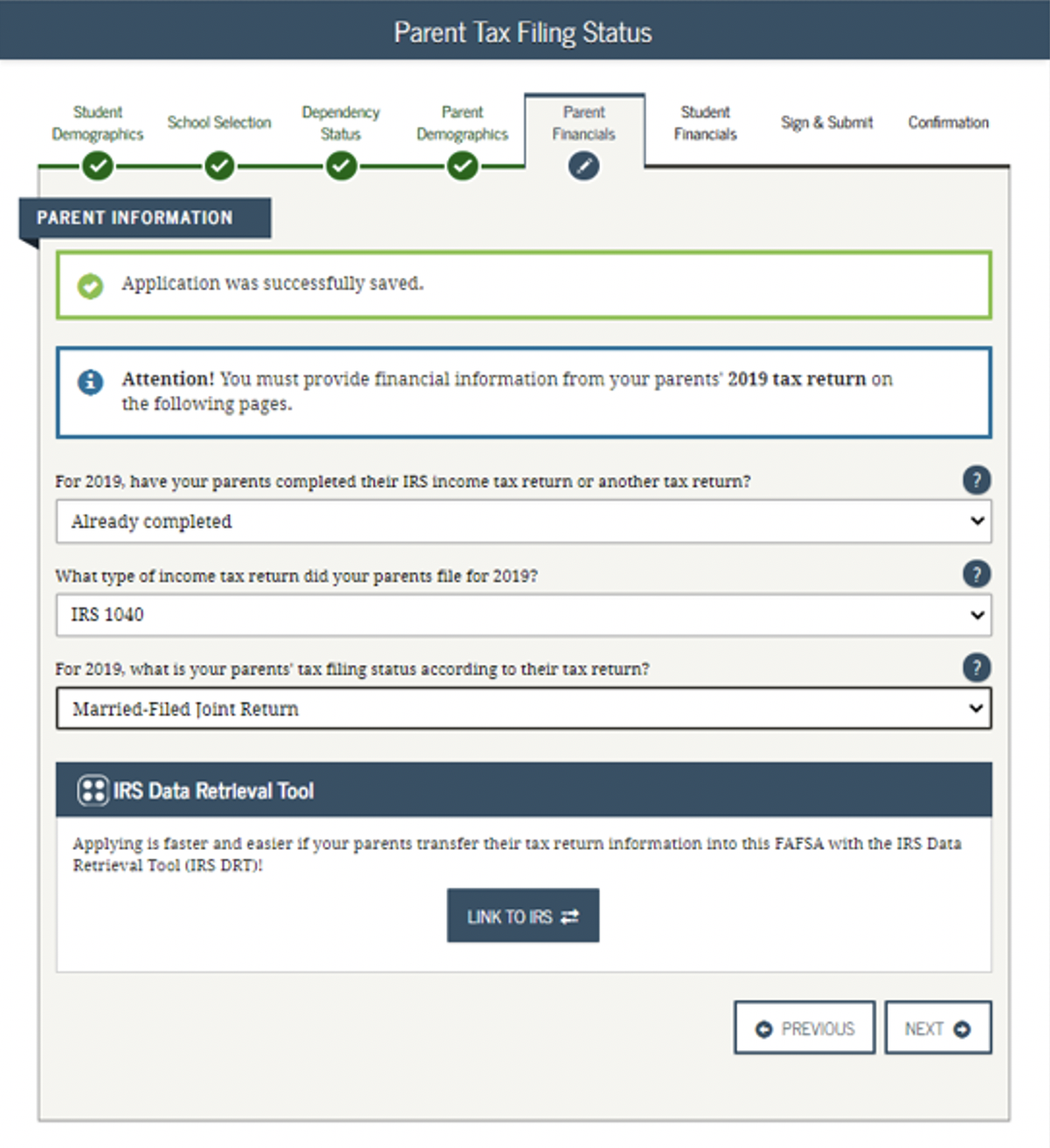

For 2020-21 the FAFSA first became available Oct. For example if you plan to attend college between July 1 2021 and June 30 2022 then youll want to apply for the 2021-22 school year. If you gather all of the documents you need ahead of time it will be much easier and faster to complete.

For the 20202021 Award Year an. June 30 2022 The federal deadline for filing the 2021-2022 FAFSA. Determine the school year for which you are applying for financial aid.

Tax return line items that are required verification data elements for the 2020-21 award year. 1 each year for the following school year. For tax filers use the parents adjusted gross income from the tax return to determine if income is 49999 or less.

You should be able to retrieve this information to automatically populate the corresponding questions on the FAFSA. Need help walking through the FAFSA. Your federal income tax returns W-2s and other records of money earned.

When is the FAFSA due. The earliest you can file the FAFSA for the 2021-2022 academic year. October 1 2020 Open date.

Tax year 2018 when making your request. 2020-21 Standard Verification Worksheet V1-Dependent Student Page 3 of 3. Your 20202021 Free Application for Federal Student Aid FAFSA was selected for review in a process called.

If you are a NYS resident whose family household federal adjusted gross income as filed on your 2018 New York State Income Tax Returns does not exceed 125000 for the 2020-21 academic year and you complete 30 credits per year you will be able to attend a SUNY or CUNY college tuition free. 1 of the year prior to each enrollment period notes Hunt. 1040 and Schedules 2020-21 FAFSA.

The FAFSA application asks about 100 questions and can take 30 minutes to fill out. For non-tax filers use the income shown on the 2018 W-2 forms of both parents plus any other earnings from work not included on the W-2s to determine if income is 49999 or less. Thats rightyou can technically go through your entire year at college before accessing the FAFSA form.

You should file your FAFSA as soon as possible after Oct. The FAFSA is available starting Oct.

Save Your Tax Documents For A Future Fafsa Startwithfafsa Org

2020 21 Fafsa Verification Irs Tax Return Transcript Matrix College Aid Services

7 Things You Need Before Filling Out The 2021 22 Fafsa Form Federal Student Aid

Early Fafsa Houston Community College Hcc

Vernon College Fafsa It S Really Not That Difficult

Fafsa 2020 21 Is Now Open And Why You Need To Apply Now Student Money Adviser

The New 2020 21 Fafsa Form Is Here The Baylor Parent Portal

Applying Office Of Student Financial Aid Uw Madison

Filling Out The Fafsa Form Federal Student Aid

How To Complete The 2021 2022 Fafsa Application

Posting Komentar untuk "What Tax Year For Fafsa 2020-21"