What Tax Year Does Fafsa Use For 2020

The FAFSA requires applicants to use tax information from an earlier tax year not the year of application. October 25 2019 1026 AM.

Ed Shares Summary Of Changes For 2020 2021 Fafsa College Aid Services

The prior year PY is the tax year before the academic year.

What tax year does fafsa use for 2020. In the past the FAFSA required people to provide tax forms from the prior tax year. In past years you could submit the 1040 1040 A and 1040 EZ tax forms the 1040A and 1040EZ are what would contribute to the eligibility for the Simplified Needs Test. The 2021-2022 FAFSA relies on 2019 tax information which may raise questions and.

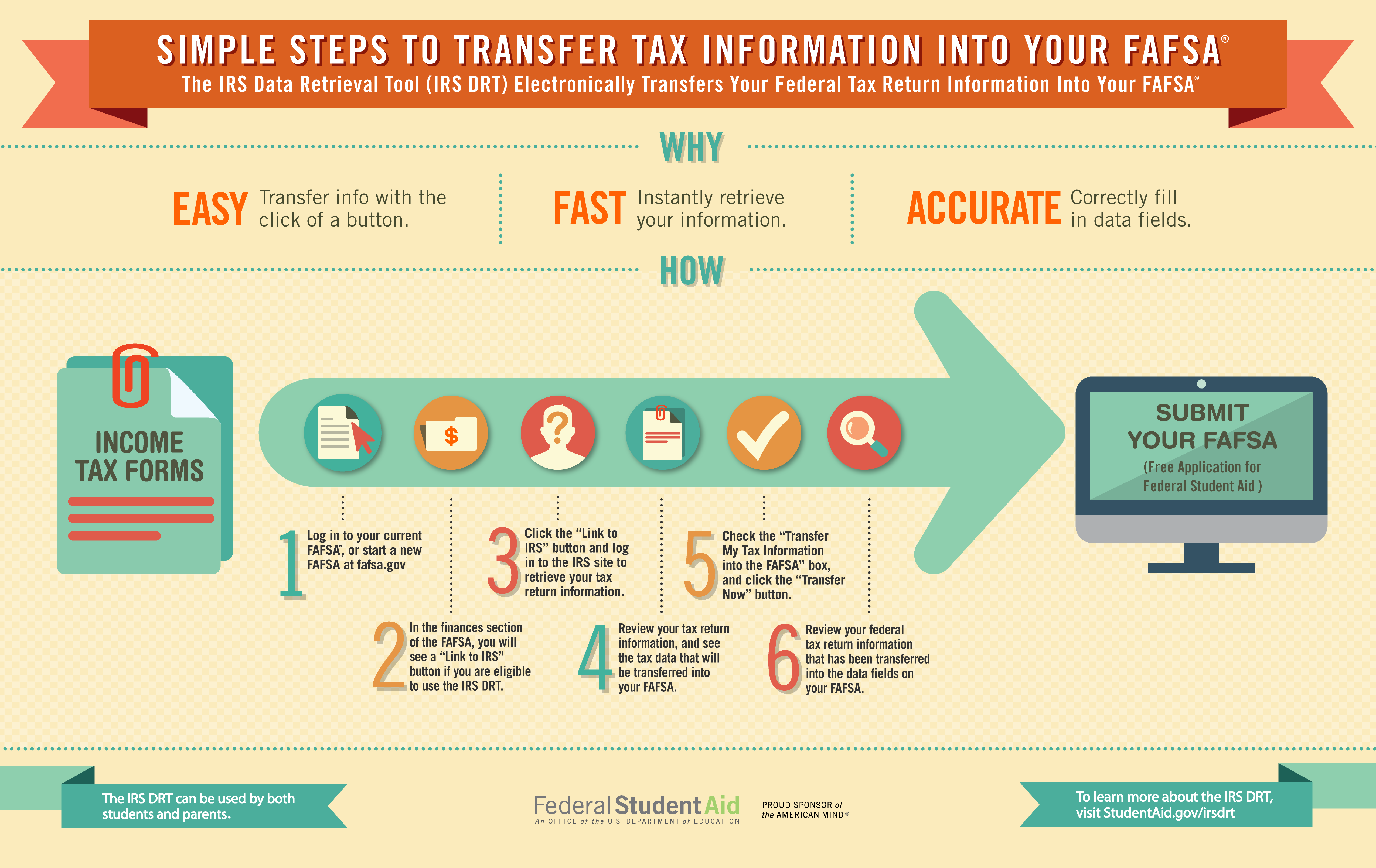

Thus the prior-prior year provides two-year-old income information. Any such income received in 2020 will be reported on next years FAFSA. The tool automatically enters your tax information exactly as it was submitted for that tax year reducing the.

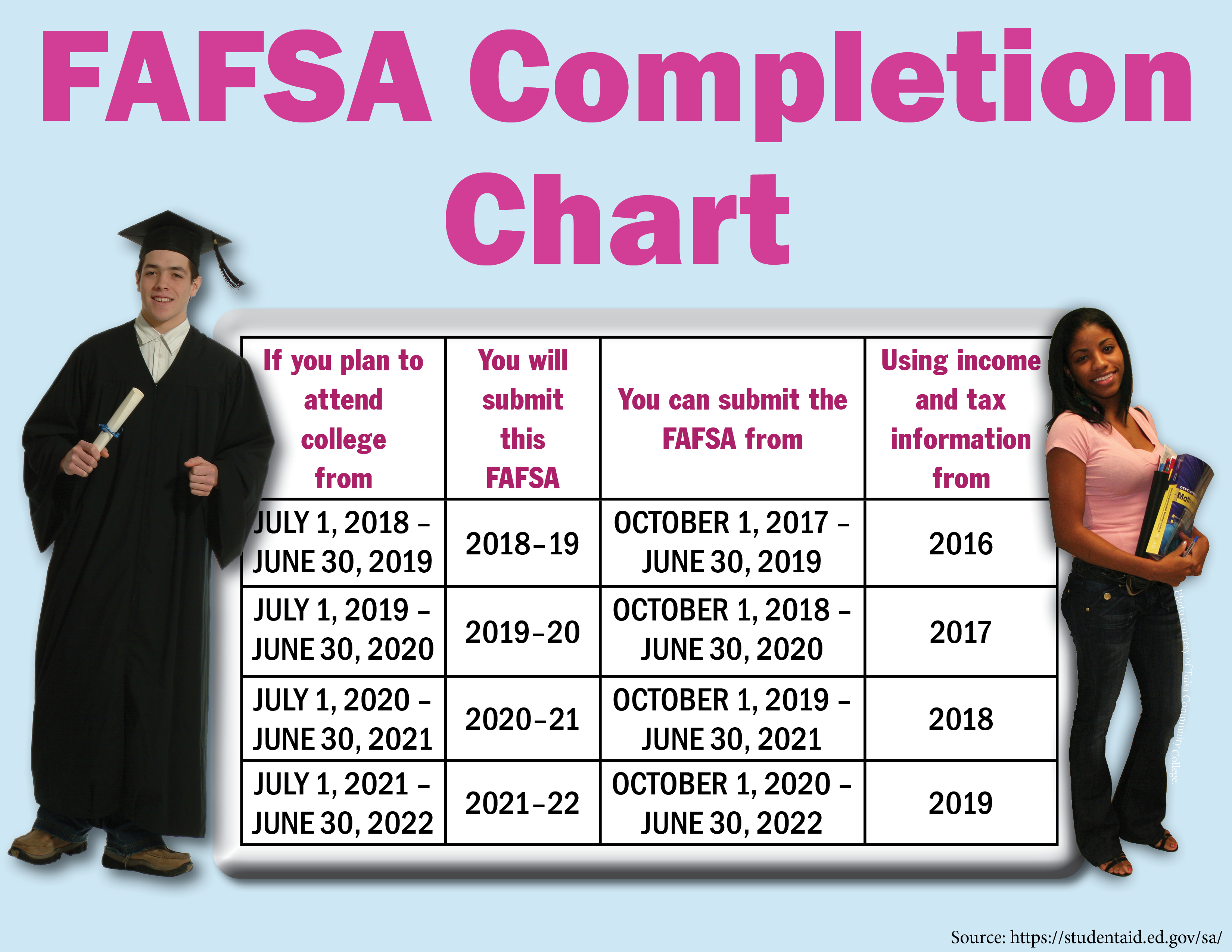

Its important to emphasize that filling out a FAFSA is good for just one school year. The 2019 - 2020 FAFSA should be completed with tax year 2017 information the prior-prior year. On the 2020-21 FAFSA form youll report 2018 tax or calendar year information when asked these questions.

As for what years tax return will be provided on FAFSA for the 202122 academic year the parents 2019 tax return will be used. The 2020-21 FAFSA form requires only 2018 tax information. January 19 2018 UCanGo2.

If you filled out the 201920 FAFSA you still need to complete the 202021 FAFSA if you want aid for the. When the FAFSAs release date was moved to Oct. One of the keys to successful 2021-22 FAFSA completion is timely completion of the 2019 federal tax.

3 riviä Academic School Year. You can simplify the process by using the IRS Data Retrieval Tool. Or the myStudentAid mobile app.

The Tax Documents You Need. The FAFSA questions about untaxed income such as child support interest income and veterans non-education benefits may or may not apply to you. If youre applying for financial aid for the 20202021 academic school year file a 20202021 FAFSA form which is based on 2018 income tax returns.

Use of the prior-prior year allows the FAFSA. The 2020-2021 Free Application for Federal Student Aid or FAFSA may look a little different to students and families who have applied for college financial aid in prior years whether they completed the form online or on a mobile device. Use Tax Year Data.

Records of Your Untaxed Income. What Years Tax Information Do I Use. The Simplified Needs Test is the formula that calculates your Expected Family Contribution EFC and increases eligibility for financial aid.

What is the Prior-Prior Year. In a few simple steps most students and parents who filed a 2019 tax return can transfer their tax return information directly. The FAFSA switched from prior-year income to prior-prior-year income starting with the 2017-2018 FAFSA for several reasons.

This means on FAFSA. The easiest way to complete or correct your FAFSA form with accurate tax information is by using the IRS Data Retrieval Tool either through fafsagov. 5 to 15 years.

Even if you the parent of the student havent filed a tax return by then due to an extension you will have 15 more days to file your 2019 tax return. Students must complete the form for each year they wish to receive aid. If youre applying for financial aid for the 20212022 school year you should file a 20212022 FAFSA form.

On or after October 1 2020. The prior-prior year PPY is the year before that. 425 to 1259.

And with all of this remember that income is based on the tax year used in the FAFSA. Starting with the 2017-2018 form the FAFSA now requires tax information from two years earlier called the. 1 in 2016 the rules about which years tax information to use were also updated.

The FAFSA opened for applicants on Oct. For the FAFSA for the 2019-2020 school year youll use the information on your 2017 tax return not your 2018 return. You cannot substitute 2020 income and tax information.

For example a family with a student beginning college in fall of 2020 might reduce pre-tax retirement contributions this year to increase taxes which are deducted from income on the FAFSA and therefore reduce EFC and then maximize contributions beginning in 2021 to reduce AGI for AOTC claiming purposes. As a result applicants use tax information that is likely already filed. Since applications for the FAFSA 202122 Award Year begins on October 1 2020 parents should have filed their taxes by then.

This years FAFSA uses 2019 income so any of the above that happened in 2019 get reported on this years FAFSA.

Financial Aid Presentation Ppt Download

What Year S Tax Information Do I Use Startwithfafsa Org

How To Complete The 2021 2022 Fafsa Application

Verification Financial Aid Home Ttu

7 Things You Need Before Filling Out The 2021 22 Fafsa Form Federal Student Aid

How To Complete The 2021 2022 Fafsa Application

Mi Student Aid What Fafsa Do I File

What Tax Year Does Fafsa Use For 2020

Financial Aid Faq Admissions University Of Nebraska Omaha

How To Complete The 2021 2022 Fafsa Application

When Is The Fafsa Deadline 2021 2022 Edvisors

Posting Komentar untuk "What Tax Year Does Fafsa Use For 2020"