What Income Do You Use For Fafsa

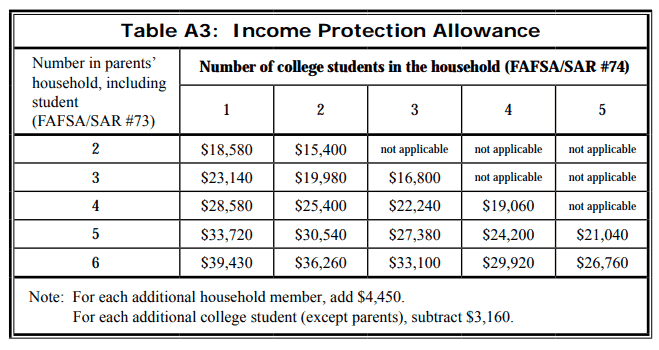

The parent income protection allowance for the same year ranges between 18580 and 39430 depending on the size of the household and number of family members in college. Yes if your income last year is similar to your income this year use last years tax return to provide estimates for questions about your income.

Vernon College Fafsa It S Really Not That Difficult

If your income is not similar use the Income Estimator in the FAFSA for assistance estimating your adjusted gross income and answer the remaining questions about your income to the best of your ability.

What income do you use for fafsa. All real estate holdings other than the house you live in must be listed as well as any business or farm assets. The EFC is calculated based on the parents adjusted gross income AGI which includes all sources of taxable income such as wages taxable. For example the FAFSA will report 2016 calendar year income for the 2018-19 Expected Family Contribution EFC determination instead of 2017.

Since the 2017-18 FAFSA instead of using prior year income as base year income the FAFSA uses prior-prior year income. However if your income has changed since the prior-prior year you can file a financial aid appeal with the colleges financial aid administrator. In addition to adjusted gross income from the 2018 tax return the FAFSA asks for a breakdown of each parents earned income taxable income untaxed income and additional financial information.

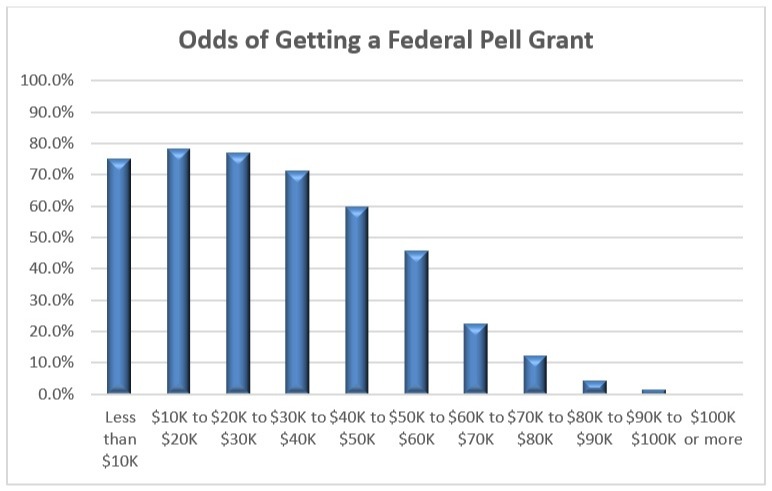

For any amount above your income protection allowance roughly every 10000 in extra income lowers your financial aid qualification by another 3000. Use Lines 7 12 18 Box 14 of IRS Schedule K-1 Form 1065 IRS Form 1040A. Some families are eligible to have the entirety of their incomes excluded from consideration by the FAFSA methodology.

If they did not file taxes they will need to enter the figures in Boxes 1 8 on their W-2 statement. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC. That can get confusing but fortunately here is the answer.

Use the information from your Form W-2s to report income earned by the student and parents. NO its not income as long as it goes into another tax-deferred account. Report the current amounts as of the date you sign the FAFSA form rather than reporting the 2018 tax year amounts.

You cannot substitute 2020 income and tax information. Will fafsa cover my entire tuition. You only include the income of your custodial parent which includes any alimony andor child support paid by the noncustodial parent.

For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero. Adjusted gross income or AGI comes straight off your familys tax form and is considered to be your income once adjustments have been subtracted. As you fill out the FAFSA youll notice that the form requires you to supply your Adjusted Gross Income.

This means you should report the exact amount from the adjusted gross income line typically line 37 of your Federal return. If youre in a FAFSA year make sure you do trustee-to-trustee rollovers so they dont show up on your tax return. Read on to get a better idea about how much you might be eligible for.

The FAFSA will want information on available cash balances in savings and checking accounts and any investment portfolios. How much income is too much for fafsa. This section includes savings and checking account balances as well as the value of investments such as stocks bonds and real estate excluding your primary residence.

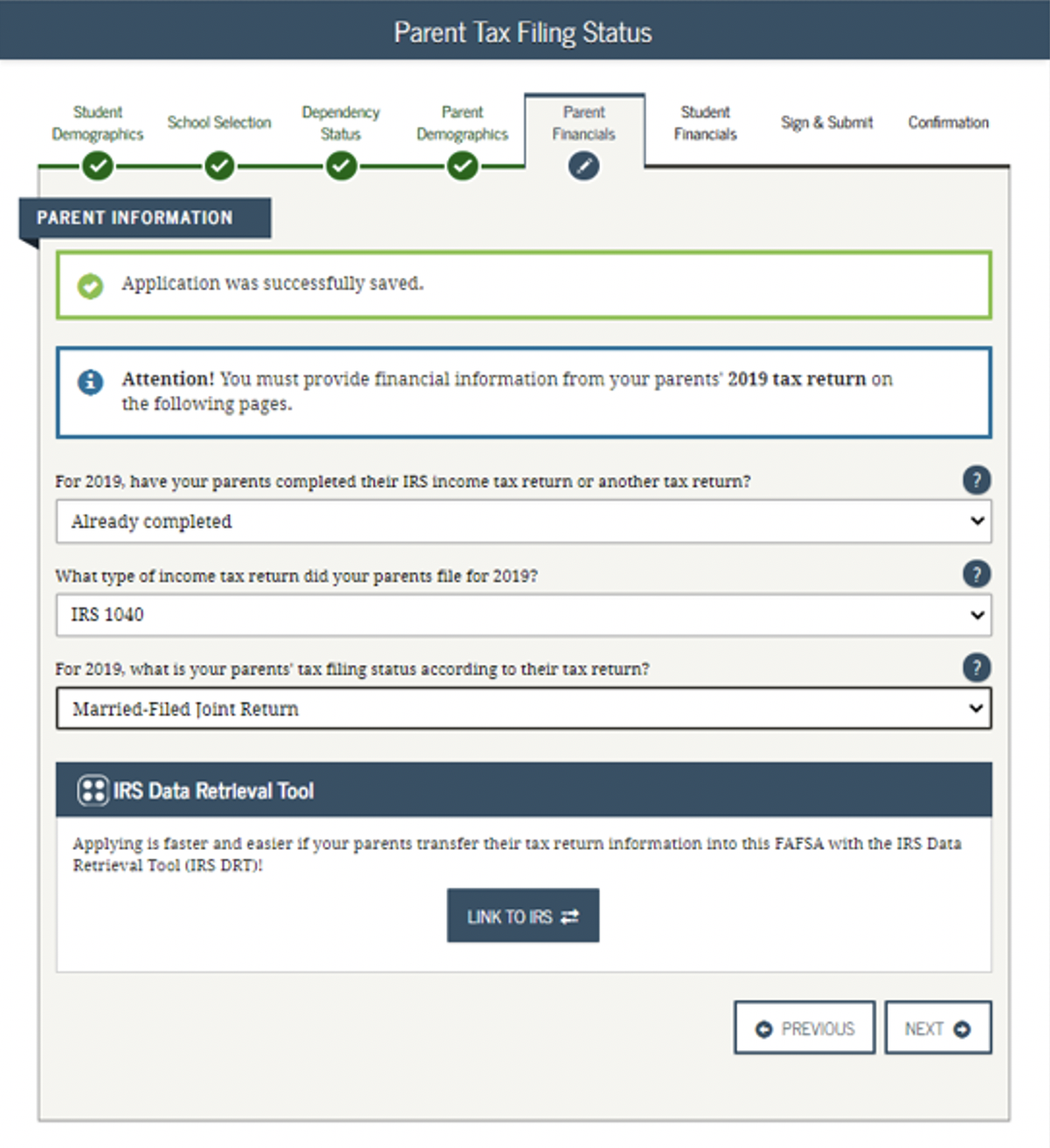

If youre filing as a dependent student. For example the 2021-2022 FAFSA is based on 2019 income and tax information. This means on FAFSA 202122 the 2019 income will be reported not 2020.

For either tax return use the following to impute their earnings. College financial aid can be used for expenses that are directly related to your education such as tuition and fees transportation books room and board supplies and related expenses like child care. The chart below from the EFC Formula Guide shows the components of parent income.

The governments FAFSA application asks for your adjusted gross income when determining your familys EFC. Are you trying to figure out what income information to provide for your parents where they are divorced and you are living with one of them. AGI and Income Earned In the income section the FAFSA asks you to report your adjusted gross income AGI.

The FAFSA asks about income as well as assets. Nonqualified withdrawals from a 529. This income-related figure comes from your federal tax return and reflects how much you earn minus a few standard deductions.

Even if you complete FAFSA form after you file your 2020 tax return you will need to use the 2019 tax return you filed in 2020. This puts both the students and parents in an advantageous position as they will be able to complete FAFSA as early as possible. You cannot substitute income and tax information from a more recent year even if the information is available.

Once the income is above 100K roughly 15th to 14th of income will be counted towards your EFC. IRA or 401k rollovers.

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

Filling Out The Fafsa Form Federal Student Aid

How To Complete The 2021 2022 Fafsa Application

True Or False You Can Fill Out Your Fafsa Before Filing Taxes U S Department Of Education

How To Complete The 2021 2022 Fafsa Application

How To Complete The 2021 2022 Fafsa Application

11 Common Fafsa Mistakes U S Department Of Education

Reporting Parent Information Federal Student Aid

How Much Is Too Much Income To Qualify For Financial Aid

Money Under 30 S Guide To Filling Out The Fafsa Money Under 30

The Fafsa Application Collegechoice

Posting Komentar untuk "What Income Do You Use For Fafsa"