What Income Do You Need For Fafsa

Employer contributions to retirement accounts. For the 2020-2021 cycle if youre a dependent student and your family has a combined income of 26000 or less your expected contribution to college costs would automatically be zero.

Reporting Parent Information Federal Student Aid

For example the FAFSA will report 2016 calendar year income for the 2018-19 Expected Family Contribution EFC determination instead of 2017 calendar year income.

What income do you need for fafsa. Unless the parents earn more than 350000 a year have only one child and that child will enroll at an in-state public college they should still file the FAFSA as there is a good chance they may qualify for federal state or institutional grants. Records of Your Assets Money This section includes savings and checking account balances as well as the value of investments such as stocks bonds and real estate excluding your primary residence. On the 2021-22 FAFSA form youll report 2019 tax or calendar year information when asked these questions.

The Office of Federal Student Aid uses the information from your FAFSA to determine your financial need. Records of your untaxed income. Your federal income tax returns from the prior prior year you dont have to wait - you can use the most recent returns you have from last year W-2s and other records of money earned.

How do I apply for the FAFSA. In general the wealthier the family the higher the EFC. If you receive income such as bank interest child support veterans benefits you will need to report this.

Your FAFSA Checklist. Its better to file a FAFSA without your parents information than to skip the FAFSA. Since the 2017-18 FAFSA instead of using prior year income as base year income the FAFSA uses prior-prior year income.

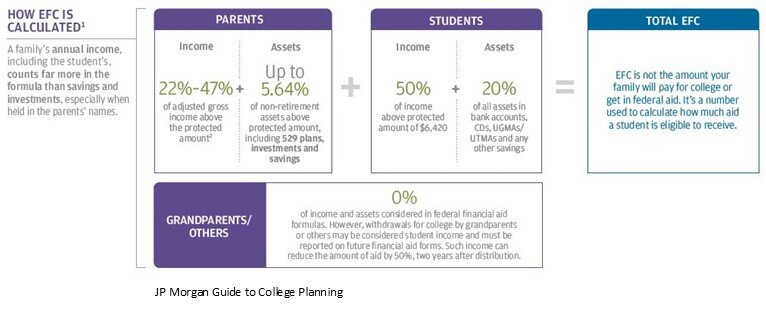

There are no income requirements or cap to the amount of money you can earn to qualify for federal student aid. The EFC is calculated based on the parents adjusted gross income AGI which includes all sources of taxable income such as wages taxable. 35000 In this case the student would be eligible for up to 35000 in need-based aid from the private college because the price of the institution far exceeds the familys EFC.

Gathering certain documents in advance will make filing the FAFSA easier. Your Social Security card and drivers license andor alien registration card if you are not a US citizen. A students financial aid package can be reduced by as much as 50 of the value of student income reported on their FAFSA.

The Free Application for Federal Student Aid FAFSA is based on income and tax information from the prior-prior year federal income tax return current asset information and current demographic information. Find specific details that pertain to parents and students. Excluded Income Non-taxable income combat pay and government assistance is generally excluded from the FAFSA as income.

Demonstrated financial need. On the 2020-21 FAFSA form youll report 2018 tax or calendar year information when asked these questions. The FAFSA uses your adjusted gross income so the income you report will be reduced by any IRS-allowable adjustments such as payments to an IRA or half of the self-employment tax.

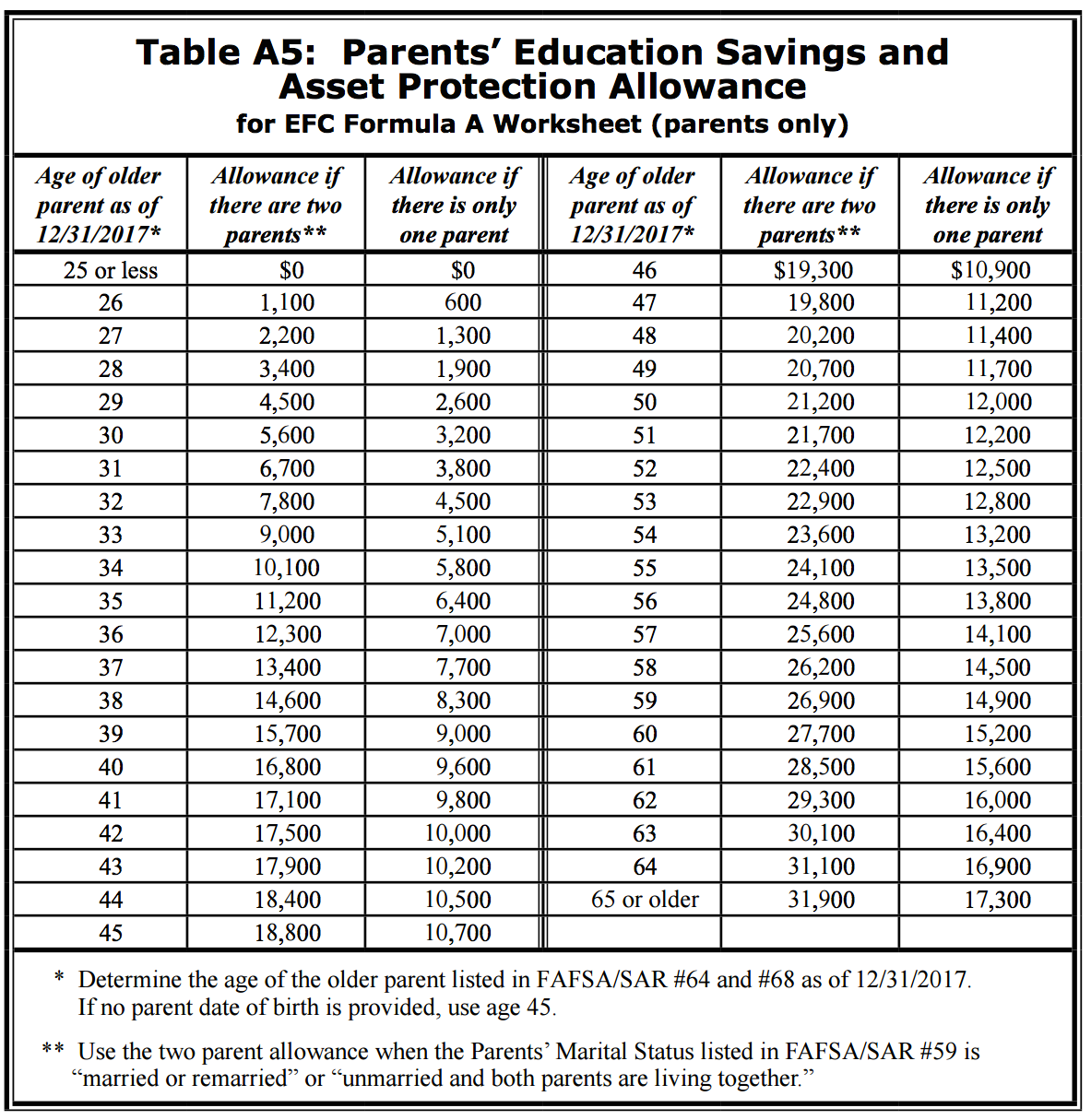

Report the current amounts as of the date you sign the FAFSA. The parent income protection allowance for the same year ranges between 18580 and 39430 depending on the size of the household and number of family members in college. What Does the Income Determine on the FAFSA.

If you are not independent do not qualify for a student dependency override and cannot convince your parents to provide their information for the FAFSA you can file without it. Many factors go into the financial aid equation such as the number of children in college and the parents age. Even though a portion of most 529 plan distributions is untaxed income it does not need to be reported for FAFSA purposes.

With the cost of the most expensive colleges today now in excess of 65000 per year even students from families with incomes over 200000 can qualify for need-based aid. If you are married report your spouses income too even if you. But there are no simple FAFSA income limits or income cutoffs on financial aid eligibility in part due to the complexity of financial aid formulas.

Students must do the same for their parents if they are a dependent student. Income information is used to calculate a reasonable percentage of your familys income and assets that can be used to. Submit an Incomplete FAFSA.

Applying for the FAFSA can be a bit of an intimidating and time-consuming experience. Your financial need is calculated by subtracting your EFC from your schools cost of attendance. You must disclose your adjusted gross income as well as all the income you earned from working.

A wide range of EFCs exists. Some families are eligible to have the entirety of their incomes excluded from consideration by the FAFSA methodology. Use your 2011 tax return when completing the 2012-2013 school year FAFSA for example.

Find specific details that pertain to parents and students. Records of Your Untaxed Income. Although there are no FAFSA income limits or maximum income to qualify for financial aid there is an earnings cap to achieve a zero-dollar EFC.

Report your income from the previous tax year on the FAFSA for the upcoming school year. Business owners do not need to include the employer portion of 401k contributions including to individual 401ks. Keep a copy of these documents in case you need them later.

The FAFSA questions about untaxed income such as child support interest income and veterans non-education benefits may or may not apply to you.

Financial Aid Eligibility Federal Student Aid

Faqs And Tips For Completing The 2021 22 Fafsa Uf Office Of Student Financial Aid And Scholarships

Do You Earn Too Much To Qualify For College Financial Aid

Fafsa Limits Is There An Income Cutoff On Eligibility For Financial Aid

Money Under 30 S Guide To Filling Out The Fafsa Money Under 30

How To Complete The 2021 2022 Fafsa Application

How Much Is Too Much Income To Qualify For Financial Aid

5 Things You Should Do After Filing Your Fafsa Form Fsa

Vernon College Fafsa It S Really Not That Difficult

Filling Out The Fafsa Form Federal Student Aid

Posting Komentar untuk "What Income Do You Need For Fafsa"